Mortgage Calculator: Affordability Check Based On Salary, Second Mortgage, Pay Off Faster June 2022

This is The Complete Guide to Calculate your Mortgage in 2021.

So if you want to know:

- Morgage affordability based on your salary

- How and why to get a 2nd Mortgage

- How and why (or not) to pay your mortgage early

We carefully crafted this guide to include actionable tips to manage your mortgage for you to save money and time!

Let’s dive right in.

When it comes to mortgages, you want to strike a balance between borrowing enough to cover your mortgage payments but not so much that they become an issue. Our mortgage affordability calculator may help you with that.

“„You don't want to end up with a mortgage you can't afford, so be honest with yourself about your monthly income and anticipated expenditures, and allow some space in your budget for emergencies or unforeseen bills.

Buying a home with a mortgage is often the most significant personal investment most individuals make. Not only does how much you can borrow rely on what a bank is willing to give you, but it also relies on a number of other variables. You must assess not just your financial situation but also your personal preferences and priorities.

Buying a house requires a lot of paperwork and patience, whether you're a first-time homeowner or a seasoned real estate investor. It's also essential to perform the math before you get your heart set on a certain home if you want to be sure you're making the correct financial choice.

| Salary: | 40,000 USD |

| Recommended Mortgage: | 120,000 USD |

| Max Mortgage: | $250,000 USD |

The lender will inform you how much of a loan you may qualify for when you are pre-approved for a mortgage. While your income and credit score are obvious factors, lenders examine your whole financial picture when determining how much money you may borrow.

Simultaneously, you should examine your finances closely to determine how much you can comfortably afford. Financial advisers have a few guidelines to follow, but it's up to you to choose how comfortable you are with debt.

In general, most potential homeowners can afford to finance a house that costs two to two and a half times their yearly gross income. According to this calculation, a $100,000-per-year earner can only afford a mortgage of $200,000 to $250,000. This estimate, however, should only be used as a basic guideline.

Finally, while choosing a home, you must examine a number of other aspects. To begin, it's a good idea to know how much your lender believes you can afford (and how it arrived at that estimation). Second, do some personal reflection to determine what kind of home you are willing to live in if you intend on staying in the house for an extended period of time, as well as what other forms of consumption you are prepared to forego or not live in your home.

While real estate has long been seen to be a secure long-term investment, recessions and other catastrophes (such as the COVID-19 epidemic) may put that notion to the test, making would-be homeowners reconsider their decision.

Remember that just because you qualify for a certain amount does not imply you can afford to make those monthly payments. You should think about your own situation as well as your future financial requirements and objectives.

The Fundamentals of the Mortgage Process | MGIC Training Webinar

The 28/36% Rule

Most financial experts believe that individuals should spend no more than 28% of their gross monthly income on housing and no more than 36% on overall debt, which includes housing as well as school loans, vehicle payments, and credit card payments. The 28/36 percent rule is a tried-and-true home affordability guideline that determines how much you can afford to spend each month.

Simply multiply your monthly income by 28 in order to calculate how much 28 percent of your income is. If your monthly income is $8,000, for example, your equation should look like this: 8,000 x 28 = 224,000. Now, divide that total by 100. 224,000 ÷ 100 = 2,240.

Your yearly salary may be sufficient to pay a mortgage, or it may fall short, depending on where you live and how much you make. Knowing what you can afford may assist you in making good financial decisions. Even if you can locate a lender prepared to underwrite the mortgage, the last thing you want to do is commit to a 30-year house loan that is too costly for your budget.

Three Times Your Salary Rule

A mortgage that is no more than three times your yearly income is optimal.

If you earn $40,000 a year, you should think carefully before taking out a mortgage that exceeds $120,000. You may easily raise your loan amount to $240,000 if you have a spouse and your combined salary is $80,000.

That isn't to say that you should always take the most expensive mortgage you can get. You'll have more wiggle space to put money into a savings account or pay for other expenses like house improvements if you choose anything less than your maximum.

For individuals who live in high-cost-of-living regions, the "three times your income" guideline may not be feasible.

If it seems that you may need a larger mortgage to purchase a house, be sure you have excellent financial standing in other areas of your life. It's critical to have a sizable emergency fund put aside to compensate for the fact that your budget will be strained. You should also have enough money set up for retirement and a separate fund to meet your move-in and closing expenses.

Larger mortgages, on the other hand, aren't necessarily ideal. To compensate for the increased risk of default, a lender may impose higher interest rates and other penalties if your mortgage represents too large a portion of your income.

What Factors Do Lenders Consider When Choosing Whether Or Not To Finance A Mortgage?

While each mortgage lender has its own set of affordability guidelines, your capacity to buy a house, as well as the amount and conditions of the loan you'll be given, will always be based on the following variables.

Debt-To-Income Ratio (DTI)

The debt-to-income ratio, or DTI, is a calculation that compares your monthly debt to your monthly income. A person with a high debt-to-income ratio will have a higher DTI, and vice versa. This is a significant figure since it indicates to borrowers your ability to take on additional debt. The greater your DTI, the more difficult it will be to get a mortgage, much alone one with a favorable interest rate. Many lenders will not accept a borrower with a debt-to-income ratio of more than 43 percent.

Credit card payments, child support, and other outstanding loans are examples of debts (auto, student, etc.).

In other words, if you pay $2,000 per month in debt services and earn $4,000 per month, your debt-to-income ratio is 50%, meaning that half of your monthly income is utilized to pay down your debt.

A debt-to-income ratio of 50%, on the other hand, isn't going to buy you your dream house. Most lenders advise that your debt-to-income ratio (DTI) not exceed 43 percent of your gross income. 3 Multiply your gross income by 0.43 and divide by 12 to get your maximum monthly debt based on this ratio.

Only debt obligations are included in your DTI, not monthly expenditures. As a result, expenses such as electricity, gym memberships, and health insurance are not required.

Subtract your total monthly debt from your gross monthly income, which is the amount you earned before taxes and deductions.

Add up your monthly debt: $1200 (rent) + $200 (car loan) + $150 (student loan) + $85 (credit card payments) = TOTAL: $1,635.

Now, divide your debt ($1,635) by your gross monthly income ($4,000). 1,635 ÷ 4,000 = .40875. By rounding up, your DTI is 41 percent.

If you get rid of the $85 monthly credit card payment, for example, your DTI drops to 39 percent.

Gross Income

This is the amount of money a potential homebuyer earns before taxes and other responsibilities are deducted. Part-time earnings, self-employment earnings, Social Security benefits, disability, alimony, and child support are all included part of your basic pay plus any bonus income.

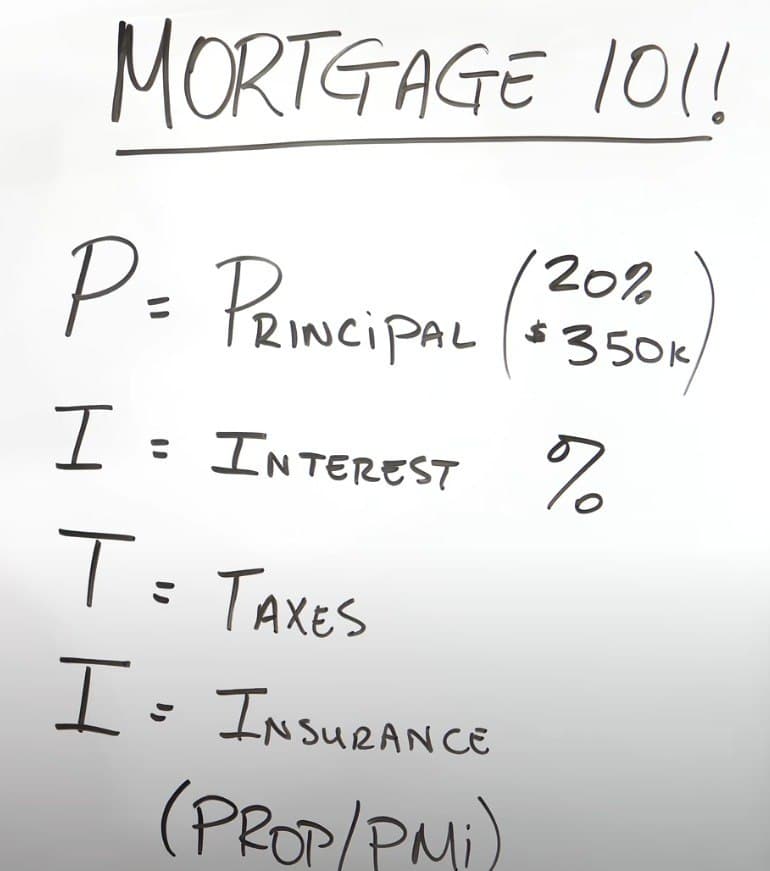

Front-End Ratio

The front-end ratio, commonly known as the mortgage-to-income ratio, is heavily influenced by gross income. This figure is the proportion of your annual gross income that may be used to pay down your mortgage each month. Your monthly mortgage payment is made up of four components, known as PITI: principle, interest, taxes, and insurance, which includes both property insurance and private mortgage insurance if your mortgage requires it.

The front-end ratio based on PITI should not exceed 28 percent of your gross income, according to a decent rule of thumb. Many lenders, however, allow borrowers to borrow more than 30%, and some even allow borrowers to borrow more than 40%.

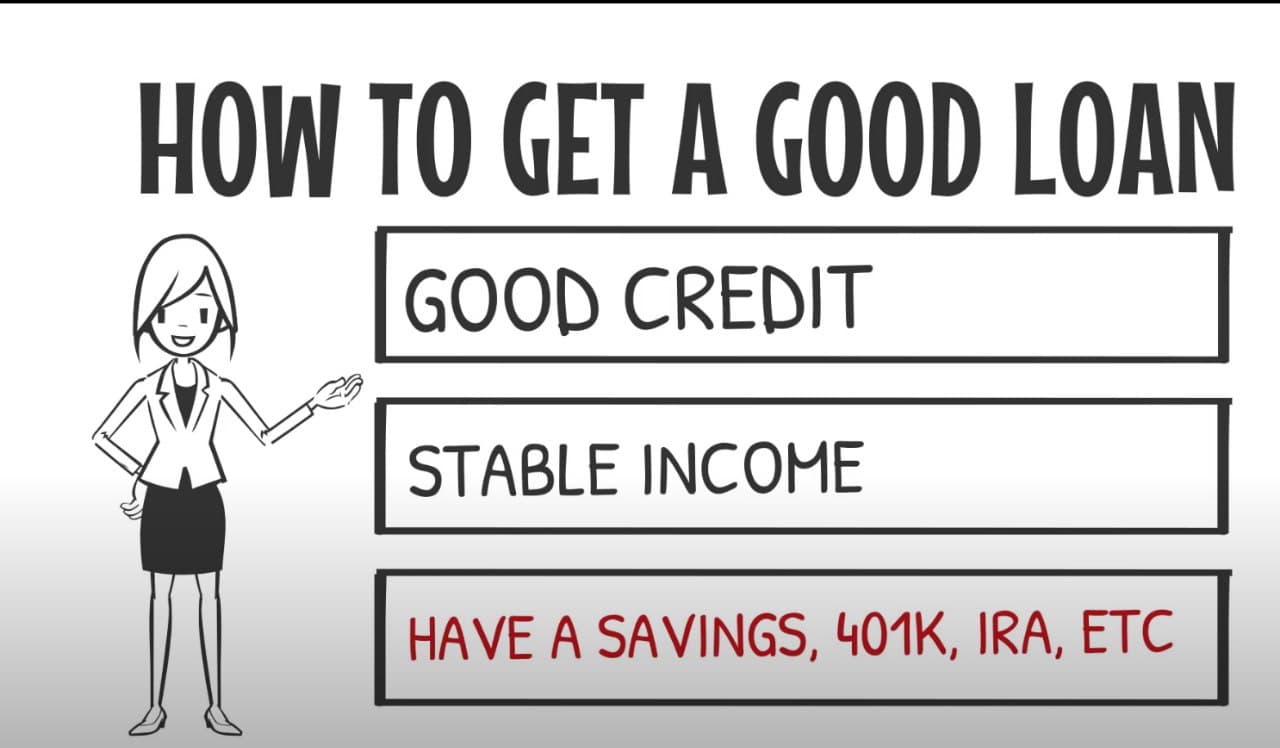

Your Credit Score

If income is one side of the affordability equation, debt is the other. Mortgage lenders have devised a method for calculating a potential homebuyer's risk level. The methodology varies, although it is usually based on the applicant's credit score.

Applicants with a poor credit score may expect to pay a higher interest rate on their loan, which is also known as an annual percentage rate (APR). Pay attention to your credit reports if you want to purchase a house soon. Make sure to pay attention to your reports. It will take time to delete any incorrect entries, and you don't want to lose out on your ideal house because of anything that isn't your fault.

How To Determine The Amount Of A Down Payment?

You may be told by a lender that you can afford a large estate, but can you? Keep in mind that the lender's requirements are based mainly on your gross income and previous obligations. The issue with utilizing gross income is straightforward: You're budgeting up to 30% of your income, but what about taxes, FICA deductions, and health insurance premiums? Even if you receive a tax refund, it won't assist you right now, and how much will you get back?

That's why some financial gurus believe it's more reasonable to consider in terms of net income and that your mortgage payment shouldn't exceed 25% of your net income. Otherwise, even if you can afford to pay your mortgage on a monthly basis, you risk being "home poor."

Paying for and maintaining your house may consume such a significant proportion of your income, far beyond the nominal front-end ratio, that you won't have enough money left over to cover other discretionary expenditures, debts, or save for retirement or even a rainy day. It's largely a personal decision whether or not to be home poor; just because you've been accepted for a mortgage doesn't imply you can make the payments.

How Lenders Make Their Decisions?

The mortgage lender considers a variety of variables when determining a homebuyer's affordability, but they all boil down to income, debt, assets, and obligations. A lender wants to know how much money an application earns, how many demands are placed on it, and the likelihood of both in the future; in other words, everything that may threaten its capacity to be repaid. Income, down payment, and monthly expenditures are often used to qualify for financing, while credit history and score influence the interest rate on the loan.

Costs Beyond The Mortgage

While the mortgage is unquestionably the most significant financial obligation of homeownership, there are many other costs, some of which persist even after the mortgage is paid off. The following things should be kept in mind by savvy shoppers:

Taxes On Real Estate

Expect to pay property taxes if you purchase a house, and knowing how much you'll owe is an essential component of a homebuyer's budget. Your property tax is determined by the city, township, or county, and is based on the size of your house and land, as well as other factors such as local real estate circumstances and the market.

According to the Tax Foundation, the effective average rate for property taxes in the United States is 1.1 percent of the assessed value of the house. This varies by state, with some having cheaper property taxes than others. For example, the average in New York is 1.4 percent, whereas the average in Oklahoma is 0.88 percent. 8 Even if your mortgage is paid off in full, you will still be responsible for paying property taxes.

Insurance For Your Home

Every homeowner needs house insurance to safeguard their home and belongings from natural and man-made catastrophes such as tornadoes and theft. If you're buying a house, you'll need to figure out what kind of insurance you'll need. Most mortgage firms will not allow you buy a house unless you have home insurance that covers the whole purchase price. In fact, your mortgage lender may need evidence of house insurance before approving your loan.

The average premium for the most popular kind of house insurance in the United States was about $1,200.9 in 2018, according to the most current data available as of early 2021. However, the cost varies based on the kind of insurance you need and the state in which you live.

Maintenance

Even if you construct a new house, it won't last forever, and neither will those costly major equipment like stoves, dishwashers, and refrigerators. The roof, furnace, driveway, carpet, and even the paint on the walls are all affected. If your finances haven't improved by the time your property needs major repairs, you may find yourself in a tough position.

Utilities

Heat, insurance, power, water, sewage, garbage collection, cable television, and telephone services are all expensive. These costs aren't included in the front-end ratio, and they aren't included into the back-end ratio. They are, nevertheless, inevitable for the majority of householders.

Fees Charged By The Association

Many condos and cooperatives, as well as gated communities and planned communities, charge monthly or annual association fees. These costs may be as little as $100 per year, or as high as several hundred dollars each month. Lawn care, snow removal, a community pool, and other services are available in certain communities.

Some payments are solely used to cover the community's administrative expenses. It's essential to note that, although more lenders are include association fees in the front-end ratio, these costs are expected to rise over time.

Decor And Furniture

Examine the amount of rooms that will need to be furnished and the number of windows that will need to be covered before purchasing a new home.

8 Easy Steps to Understand the Mortgage Process!

The amount you may borrow for a mortgage is determined by many variables, including your income, bill payments, and any other recurring obligations, such as school loans or credit card bills.

The amount you may borrow for a mortgage is determined by many variables, including your income, bill payments, and any other recurring obligations, such as school loans or credit card bills.

When a mortgage lender estimates how much they might ideally give you for a mortgage, these variables are taken into account. Interest rates are also a factor to consider, and most mortgage lenders will guarantee that you will be able to repay the loan even if interest rates rise.

A second house mortgage is different from a remortgage or a second charge mortgage since it is used to purchase a second property. Second mortgages are for individuals who want to buy a second home as a buy-to-let investment or a vacation house to rent out.

They may also be nearing the conclusion of their first mortgage payments and are confident in their ability to take out a second mortgage. It operates in the same manner as a first mortgage, but with more stringent affordability requirements since paying off a second mortgage may put a considerable burden on your finances.

So, if you're looking for a mortgage for a second property, you'll need to make sure your finances are in order. You may use a second home mortgage calculatorto figure out how much you want to borrow and what your monthly payments will be.

How Does A Second Mortgage Work?

Although the equity in your house is a significant asset, unlike more liquid assets such as cash, it is usually not something you can use.

A second mortgage, on the other hand, enables you to put your home's equity to work. Instead of being locked up in your house, that money is now accessible for current needs. Depending on your financial objectives, this may be beneficial or detrimental.

The lender you deal with will determine the specific criteria for being accepted for a second mortgage. The most fundamental condition, though, is that you have some equity in your house.

Depending on the value of your house and the outstanding loan debt on your first mortgage, your lender will likely only allow you to take out a part of this equity so that you retain a specific level of equity in your home (typically 20% of its value).

You'll most certainly need a credit score of at least 620 to get accepted for a second mortgage, but specific lender requirements may be higher. Also, keep in mind that higher scores correspond to greater rates. You'll almost certainly require a debt-to-income ratio (DTI) of less than 43 percent.

How Does Home Equity Work?

Let's study a little more about home equity before diving further into what second mortgages are and who they're for. When you take out a second mortgage, your home equity affects how much money you may obtain.

A lien stays on your property until your mortgage loan has no outstanding amount. If you fail on your mortgage loan before it is paid off, your lender has the authority to take it back. The part of your loan that you have paid off is termed equity when you pay down your main loan amount over time.

It's simple to figure out how much equity you have in your house. Subtract the amount you've paid toward your mortgage's principal balance from the total amount you owe.

For example, if you purchased a $200,000 house and paid off $60,000 in equity, including your down payment, you now own your home with $60,000 in equity. Your home equity is not affected by the interest you pay.

There are other methods to enhance your home equity. The value of your house increases if you live in a very strong real estate market or if you make changes to it. This improves your equity without requiring you to make more payments. If the value of your house decreases and you join a buyer's market, on the other side, you may lose equity.

What Is A Second Charge Mortgage, And How Does It Work?

Some individuals considering purchasing a second home may consider a second charge mortgage, which is often referred to as a second mortgage, although these are two different kinds of loans.

A second charge mortgage is a secured loan that you take out against your house and utilize the equity to help generate funds for a second mortgage to purchase a new home.

Because your current property is used as security, the affordability tests on a second charge mortgage or secured loan are less stringent. A second mortgage, on the other hand, is nothing more than a fresh loan.

Types Of Second Mortgages

Home equity loans and home equity lines of credit are the two kinds of second mortgages.

Home Equity Loan

In the same way that a cash-out refinancing enables you to withdraw a lump-sum payment from your equity, a home equity loan does. Your second mortgage provider offers you a portion of your equity in cash when you take out a home equity loan.

The lender receives a second lien on your property in return. Just like your initial mortgage, you repay the loan in monthly installments with interest. The majority of home equity loans have durations ranging from 5 to 30 years, which means you must repay them within that time period.

When you take out a home equity loan, you receive a lump amount of money that you pay back over time in set monthly installments. If you know precisely how much money you need to borrow or enjoy the concept of getting all of your cash at once, you may be a suitable candidate for a home equity loan.

Home Equity Line Of Credit

A HELOC operates similarly to a credit card in that you are given a credit limit and may borrow as much or as little as you like. A HELOC may make sense if you want the flexibility of being able to borrow money as needed.

There are two time periods in this kind of second mortgage: the draw period and the payback term. You are allowed to withdraw whatever amount of money you need throughout the draw time which may last anywhere from 5 to 10 years up to your limit. You'll just have to pay interest on what you borrow on a monthly basis.

Once the draw time has ended, the payback term (typically 10–20 years) will begin, and you will be required to return the principle as well as any interest on the amount borrowed. During the payback term, you will not be able to borrow money from your HELOC.

A HELOC may be used for any reason, but it's especially useful if you have a significant financial requirement, such as college tuition or a complete home renovation, that you wish to stretch out over time.

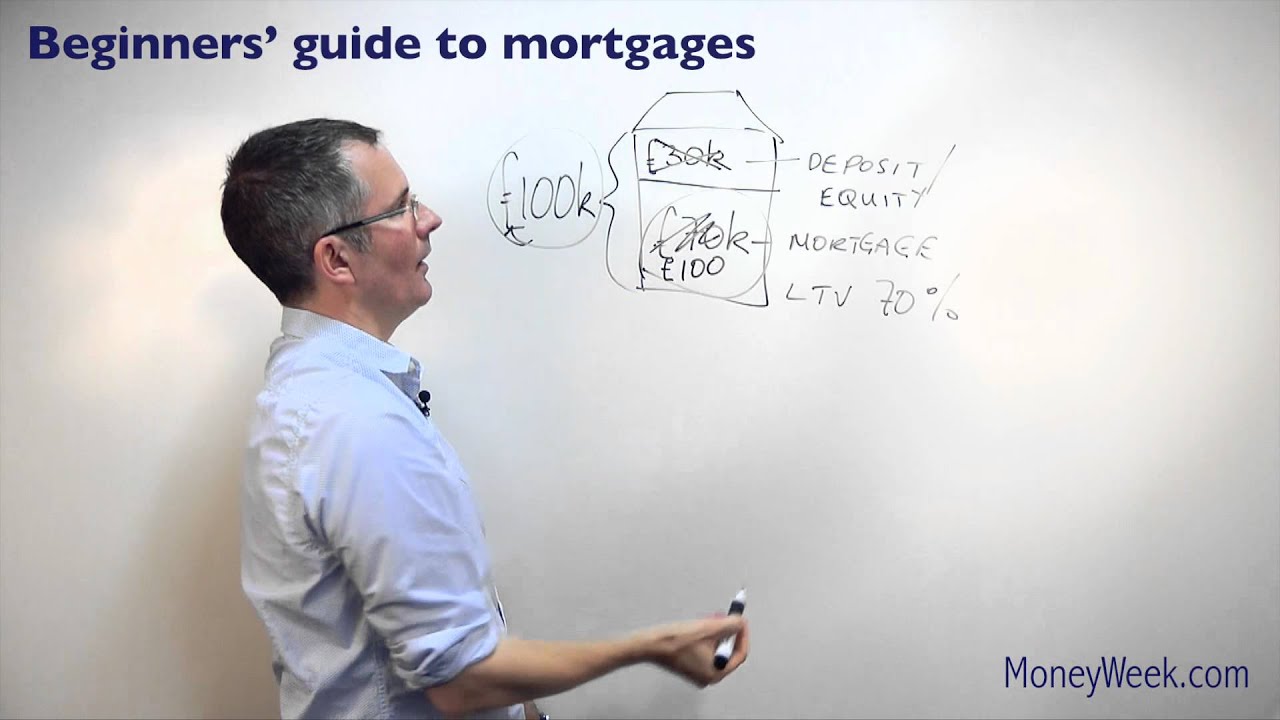

Beginners' guide to mortgages - MoneyWeek investment tutorials

What Factors Influence My Second Mortgage Application Approval?

Your existing mortgage agreement will be seen by all banks, building societies, and other mortgage providers as paying for your primary house.

If you purchase another house, your mortgage provider will consider it your second home if you apply for a loan.

Even whether you intend to reside in the second house or rent it out, your application will be considered as a second home mortgage since you already have one.

You should first inquire with your existing mortgage provider to see whether they would give you a second mortgage, since not all mortgage companies do. It's quite probable that if you apply for a second home mortgage with any of the lenders, you'll be met with tougher requirements.

In general, a greater deposit is required for a second home mortgage than what you were permitted for your first mortgage. Furthermore, interest rates on second home mortgages are likely to be higher than on ordinary mortgages.

What Is The Process For Getting A Second Mortgage?

You'll go through all of the same financial checks as normal, but the mortgage lender will be more cautious about lending to you since paying two mortgage payments every month will be more costly.

Banks are more willing to lend to you if you have some form of security to protect them if you don't pay back your loan.

Property is generally regarded as the primary form of security, which means that if you default on your second charge mortgage or secured loan, the bank may take your present residence.

What To Consider About When Getting A Second Mortgage?

There's no disputing that a second mortgage has a lot of benefits. However, just like any other financial instrument, there are certain drawbacks to consider before you take one out.

When you take out a second mortgage, you are putting your house on the line because if you stop making payments, your lender will foreclose on your house. In addition, when interest, closing expenses, and fees are taken into account, a second mortgage may be costly. Furthermore, it may place a burden on your finances. You may wind yourself in severe debt if you lose your job or have an unexpected medical expense.

While these dangers aren't necessary grounds to forgo a second mortgage, they should be taken into account.

How To Get A Second Mortgage

Examine your financial position carefully: Calculate your DTI and see whether you can afford to take on more debt once you know your credit score.

Determine how much equity you have in your home: Subtract the amount owed on your mortgage from the current market value of your property.

Decide what kind of second mortgage you want: Are you looking for a HELOC or a home equity loan? Whether you want a flat amount of cash or a revolving line of credit will determine the response.

Take a look around: Find lenders that provide your preferred second mortgage by doing some research. Look for loans from banks, credit unions, and internet lenders.

Speak with a Home Loan Specialist: It's a good idea to contact a Home Loan Expert after you've discovered an option or two that fits your budget and requirements. They'll be able to answer any questions you have and guarantee you're making the best choice possible.

Pros And Cons Of Second Mortgages

Pros Of A Second Mortgage

Second mortgages may result in substantial debt amounts. Some lenders may let you borrow up to 90% of the value of your house in a second mortgage. This means you can borrow more money with a second mortgage than you can with other kinds of loans, particularly if you've been paying on your first mortgage for a long period.

Credit cards have higher interest rates than second mortgages. Second mortgages are classified as secured debt, which implies they are backed by something (your home). Second mortgages have lower interest rates than credit cards since the lender is less likely to lose money.

There are no restrictions on how much money may be spent. There are no restrictions or limitations on how you may utilize the funds from your second mortgage. The sky is the limit when it comes to arranging a wedding or paying off student debt.

Cons Of A Second Mortgage

The interest rates on second mortgages are greater. The interest rates on second mortgages are often higher than those on refinances. This is due to the fact that lenders are less interested in your property than your main lender.

Second mortgages may place a strain on your finances. When you take up a second mortgage, you agree to pay two mortgage payments each month: one to your primary lender and another to your secondary lender. This may put a burden on your family's budget, particularly if you're already living paycheck to paycheck.

Is A Second Mortgage Right For You?

Second mortgages are liens secured by a part of your home's equity that has been paid off. Your lender may offer you a single lump-sum home equity loan or a revolving line of home equity credit when you take up a second mortgage. If you default on your second mortgage, your lender has the right to repossess your house.

Refinances are distinct from second mortgages in that they add another monthly payment to your budget rather than altering the terms of your existing loan. Because the lender has less of a claim on the property than the main lender, second mortgages are generally more difficult to get than cash-out refinances. Second mortgages are often used to cover significant, one-time expenditures such as consolidating credit card debt or paying for college tuition.

Before taking for a second mortgage, think about all of your choices and be sure you can afford the payments.

Chapter 3:How To Pay Off My Mortgage Faster?

Paying off a mortgage early may save you tens of thousands of dollars in interest since mortgages are often huge debts that last for decades or more. Not to mention the relief of not having to worry about a monthly mortgage payment.

Paying off a mortgage early may save you tens of thousands of dollars in interest since mortgages are often huge debts that last for decades or more. Not to mention the relief of not having to worry about a monthly mortgage payment.

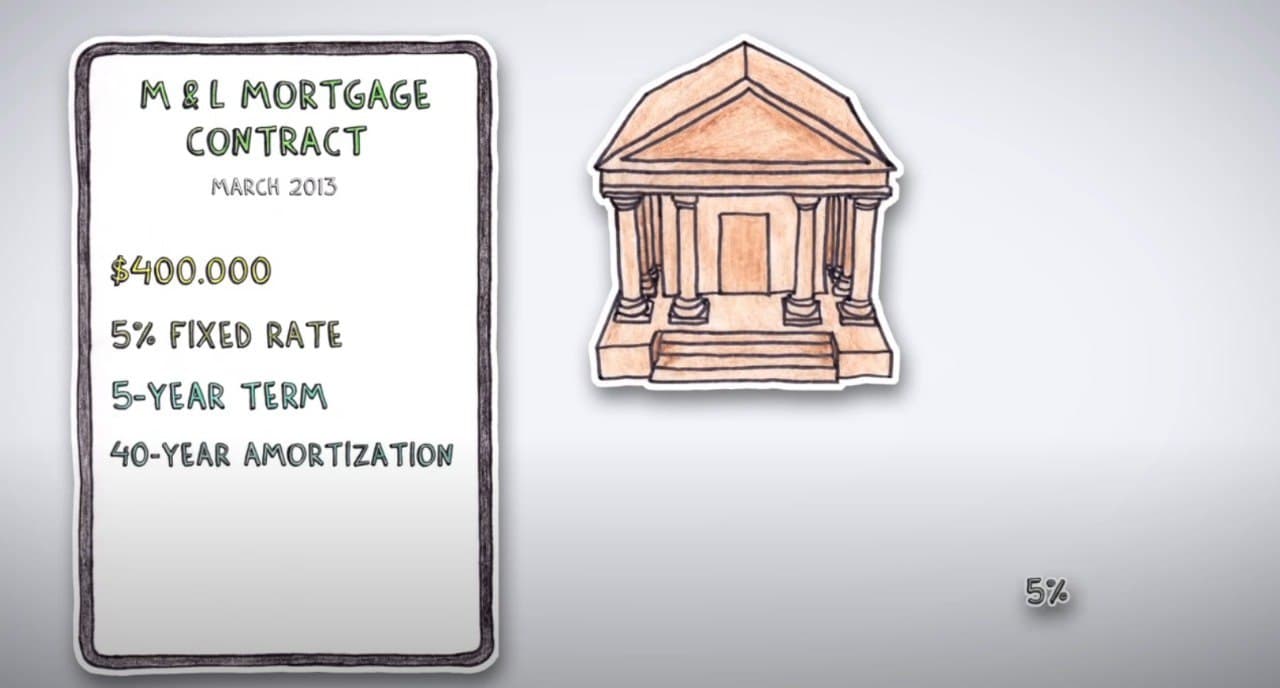

The payment is divided between principle and interest when you submit your monthly check to your mortgage lender. A significant part of the payment is allocated to interest early on in the loan. As time passes, a larger portion of the payment is applied to the principle. This is known as amortization, and it enables the lender to recoup a greater part of their investment in the first few years. Extra payments to the principal are the key to paying off your mortgage early.

Ask yourself the following questions before deciding to pay off your mortgage early:

- Is there enough money in my emergency fund to cover at least six months' worth of expenses?

- Are my savings for retirement and other key financial objectives on track?

- Do I have any high-interest debt, such as credit cards, and if so, how much?

If you can answer yes to all three questions, paying off your mortgage early may be a wise financial decision. Keep in mind that some lenders impose a prepayment penalty; if yours does, be sure to account for that as well.

6 Ways To Pay Off Your Mortgage Early

Make Additional Payments

The first option is to divide your monthly mortgage payment in half and pay it bimonthly instead. You'll wind up paying the equivalent of 13 months' worth of mortgage payments in a year instead of the usual 12. Because it is hardly visible in the monthly budget, this strategy may be simple for some homeowners.

You should check with your lender to see whether they accept biweekly payments; some don't. It's up to you to put aside those biweekly payments in this instance, but you'll make them all at once each month. The advantage of the additional yearly payment remains, but without the convenience of a monthly payment split from the lender.

The second option is to pay more each month to reduce the principle quicker, which may save you tens of thousands of dollars over the course of the loan.

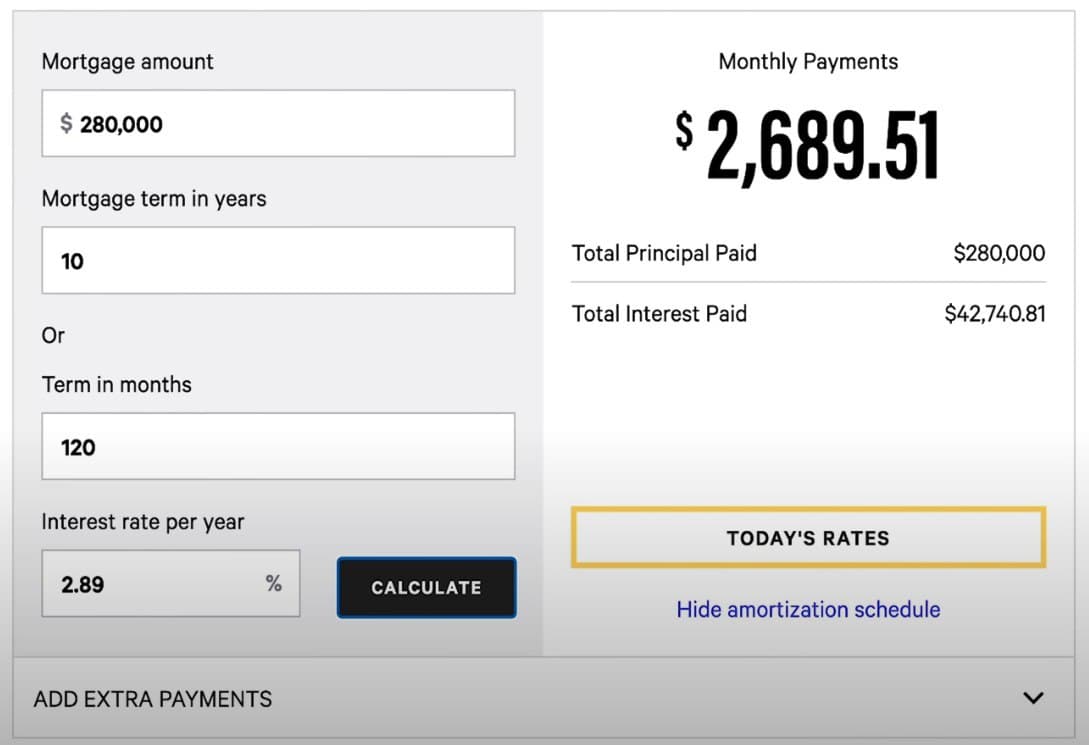

Let's assume you have a $250,000 30-year mortgage with a 4% interest rate. You may cut four years and $27,957 off your mortgage if you make an extra $100 monthly payment to the main amount of your loan.

This is a better strategy than refinancing since it does not bind you to a payment. You will not be punished if you are unable to increase your monthly mortgage payment due to unforeseen circumstances.

If you choose this option, be sure to double-check with your lender that the payments will be allocated to the principle rather than the interest. Make sure the lender knows that the additional payment isn't for the following month's mortgage payment.

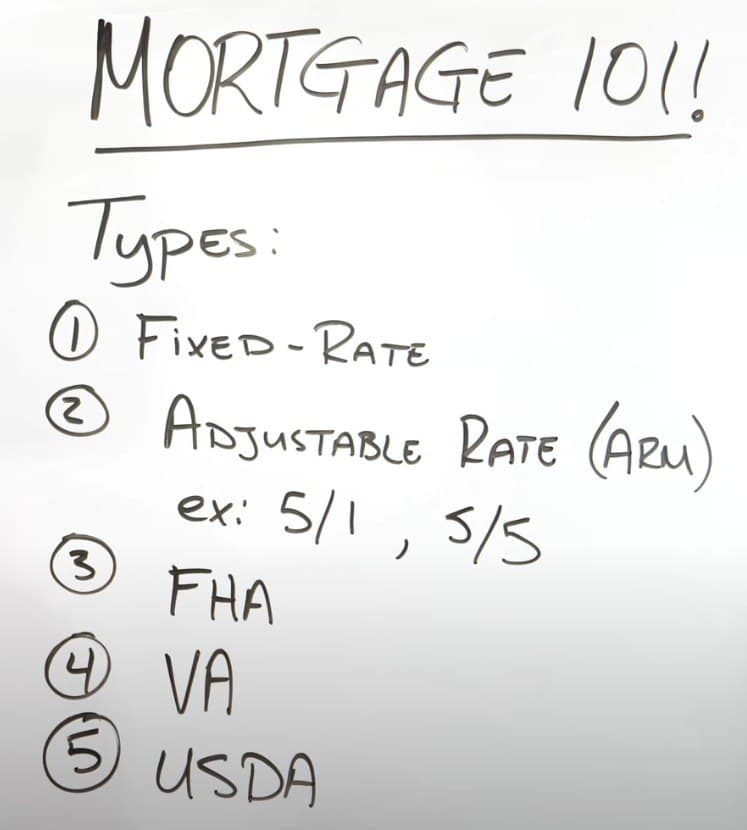

Refinance To A Shorter Term

The 30-year mortgage is the most common, although lenders sometimes offer shorter credit periods. A 15-year loan is a popular option, but many lenders also provide 10-, 20-, and 25-year loans.

Shorter repayment durations result in greater monthly payments but lower interest throughout the loan's lifetime. Consider the difference between a 20-year and a 30-year tenure.

The majority of 20-year mortgages have lower interest rates than 30-year mortgages. 20-year rates are typically one eighth (0.125%) to a quarter percent (0.25%) lower than 10-year rates.

Assume you're taking out a $250,000 loan with a 3.75 percent interest rate over 30 years. Your monthly principle and interest payments would be about $1,150. Your monthly payment would be $1,450 if you had the same loan amount but a 20-year term at 3.625 percent.You'd pay a few hundred dollars more each month, but you'd be debt-free ten years sooner.

What's the greatest part? If you maintained that 20-year mortgage until it was paid off, you would save almost $65,000 in interest.

Another advantage of refinancing to a shorter term is that you won't have to start over with another 30 years of payments. Starting again with another 30 years of interest may not make sense for many homeowners who are far into their initial mortgage term.

A 15-year refinancing, on the other hand, allows you to lock in a low interest rate and a shorter loan term, allowing you to pay off your mortgage quicker. Just keep in mind that the shorter the loan period, the greater your monthly payments will be.

Make An Additional Mortgage Payment Each Year

Making an additional mortgage payment each year may substantially shorten the length of your debt. The most cost-effective method is to pay 1/12 more each month. For example, if you pay $975 each month on a $900 mortgage, at the end of the year, you'll have paid the equivalent of an additional payment.

To pay off their mortgage quicker, many homeowners opt to make one additional payment each year. Paying half your mortgage payment every other week instead of the entire amount once a month is one of the simplest methods to make an additional payment each year. This is referred to as "biweekly payments."

When you pay bi-weekly rather than monthly, you end up with one additional payment each year. You can't, however, start paying payments every two weeks. It's possible that your loan servicer is perplexed by your sporadic, incomplete payments. To set up this plan, speak with your loan servicer first.

Alternatively, you may make a 13th payment at the end of the year. However, this approach necessitates the provision of a large amount of cash. Some homeowners choose to make their additional payment in conjunction with their tax return or an annual bonus at work.

Making an additional payment each year, whatever you arrange it, is a fantastic method to pay off a mortgage early.

For example, if you borrowed $200,000 over 30 years at 4.5 percent, your monthly principle and interest payment would be about $1,000. Your 30-year term might be shortened by 4½ years if you paid an additional $1,000 each year. If you keep the loan to the end, you'll save almost $28,500 in interest. There are additional benefits to paying off your mortgage fast.

Lowering your amount, for example, means you'll be able to cease paying private mortgage insurance (PMI) payments sooner. When you pay off 20% of the initial loan amount on a conventional loan, you may eliminate PMI.

Refinance Your Mortgage

If you can obtain a cheaper interest rate, refinancing your mortgage to pay it off sooner makes sense. Remember that there are fees involved with refinancing, so be sure the savings outweigh the expenses.

Refinancing into a shorter-term loan, such as from a 30-year to a 15-year mortgage, may also help you save money on interest while putting you on the road to early payback. You may compare payments and total interest between 30-year and 15-year periods using Bankrate's calculator.

Recast Your Mortgage

Recasting a mortgage differs from refinancing in that you retain your current debt. You just make a one-time payment to the principle, and the bank will modify your repayment plan to reflect the new amount. As a consequence, the loan duration will be reduced.

The costs associated with recasting are considerably lower than those associated with refinancing. The cost of recasting a mortgage is usually just a few hundred dollars. Refinance closing expenses, on the other hand, are often a few thousand dollars.

Plus, if you currently have a low interest rate on your mortgage, you may retain it when you refinance. Refinancing may be a better choice if your interest rate is higher. If you prefer this option, talk to your lender or servicer about it. A mortgage recast is not permitted by all businesses.

Make Lump-Sum Payments To Your Principal

Making lump-sum payments to your principle when you can is an alternative to recasting. Homeowners who get big bonuses, inherit money, or sell valuable goods may opt to pay down their mortgage with the additional funds.

Because VA and FHA loans aren't recastable, lump-sum payments may be the best option for consumers with these loans. You'll also save the recasting cost charged by the lender.

Some mortgage servicers require you to indicate when additional funds should be applied to the principal. If you're not sure how lump-sum payments will be applied, check with your servicer.

Round Up Your Mortgage Payments

Rounding up is another method to drastically decrease the term of your mortgage. Round up to the next largest $100 number when planning for your mortgage payment. Instead of $743, pay $800. Alternatively, instead of $860, you may pay $900.

Introduction to Mortgage Loans | Housing | Finance & Capital Markets | Khan Academy

Pros And Cons Of Paying Off Your Mortgage Early

Paying off your mortgage early may save you money in the long run. When you stop paying payments, you'll have more money to play with each month and you'll save money on interest.

Making additional mortgage payments, on the other hand, isn't for everyone. Instead, you may be better off concentrating on other debts or investing the money. The benefits and drawbacks of paying off your mortgage early are listed below.

4 Benefits Of Paying Off Your Mortgage Early

Save money without paying interest. Each month, a portion of your mortgage payment goes toward interest, so the fewer payments you make, the less interest you'll pay. You might save tens of thousands of dollars by paying off your mortgage early. (Just be sure to tell your lender that any additional payments would only be applied to the principle, not interest.)

There will be no further monthly payments. You may put that money toward other things by reducing monthly mortgage payments. You might, for example, invest the additional funds or use them to pay for your child's college tuition.

You are the only owner of the property. It's possible that if you have a financial setback, you won't be able to make your monthly mortgage payments. If you fall behind on your payments, your home may be repossessed. There is no risk of losing your home when you own it outright.

Mindfulness. You may just like the notion of not having a mortgage to worry about. The independence that comes with not having to pay a mortgage is a strong incentive.

4 Drawbacks Of Paying Off Your Mortgage Early

Investing allows you to earn more money. Right present, the average mortgage interest rate is about 3%. Over a ten-year period, the average stock market return is about 9%. So, if you pay off your mortgage 10 years early vs investing in the stock market for 10 years, you'll almost certainly come out ahead by investing.

Prepayment penalties apply to mortgages. A mortgage prepayment penalty is a charge you pay the lender if you sell, refinance, or pay off your mortgage within a specified period of time after the original mortgage closes - typically three to five years. This cost isn't charged by all lenders, and if you're paying off your mortgage in more than five years, you generally won't have to worry about it. However, you should always consult with your lender first.

The mortgage interest tax deduction is no longer available. You may deduct the amount you pay in mortgage interest from your taxable income if you are a homeowner. If you pay off your mortgage early, you'll forfeit this benefit.

Your credit score will be harmed. Your credit score is determined by a number of variables, one of which is the mix of credit kinds you have. You may, for example, have a credit card, a vehicle loan, and a mortgage. Your credit score will drop if you remove one kind of credit. This should be a minor change, but it's worth thinking about.

Is It Possible For You To Pay Off Your Mortgage Early?

You may pay off your mortgage early without penalty in most instances, but there are a few things to consider before doing so.

To begin, inquire with your loan servicer about if your mortgage includes a prepayment penalty. If it does, you'll be charged a fee if you pay off your loan ahead of time. This may have an impact on whether or not paying off your mortgage early is financially feasible for you.

Second, check to see if there are any limitations on how and when you may make extra payments. Some loans contain conditions that encourage you to stick to the payment schedule, and it's critical to make sure that any additional payments go toward the principle rather than interest.

Top 10 Questions To Ask Yourself Before Paying Off Your Mortgage Early

How Would You Put The Money You'd Save On Monthly Payments To Good Use?

If you're paying off your mortgage early to free up more monthly cash flow, you should have a plan in place for how you'll spend it. If you wish to invest $900 each month instead of paying your $900 mortgage payment, it might be a smart use of the money.

It's ultimately up to you to decide how to spend the additional income. Paying off your mortgage early may not be the greatest financial decision if you can't think of what you want to do with the money or if you'd spend it on frivolous items. Here are 10 questions to ask yourself before paying off your mortgage early

What Other Debts Do You Have?

This is the first time knowing your mortgage rate is useful since it allows you to compare like-for-like the rates you're paying on all of your loans.

Here's a simple rule of thumb: pay off your most costly loans first. I know that seems like a silly thing to say, but you'd be shocked how many people don't do it properly.

Many people make the mistake of thinking that the amount they owe is what makes the loan costly, while the interest rate is what matters. The higher the interest rate, the greater the risk of debt growth, which makes paying it off more difficult over time.

Check the rates of interest you're paying if you have credit cards, store cards, personal loans, or other high-interest debt. If they are greater than your mortgage, you should pay them off before considering overpaying your mortgage.

Is Your Retirement Strategy On Track?

Spend some time assessing the feasibility of your retirement plan before paying off a mortgage, either by sitting down with a financial adviser, utilizing internet calculators, or both. Yes, paying off a mortgage instead of investing in the stock market would result in less liquid investment assets put up for retirement. With reduced household expenditures, you may be able to increase your future retirement-plan contributions; having a paid-off home also means lower in-retirement costs, enabling you to decrease your anticipated withdrawal rate.

The decision-making process here is heavily influenced by the time horizon. Those who have more years until retirement can better take advantage of the compounding benefits of investment assets they put to work today, whereas those who are nearing or in retirement and plan to start drawing on their investment assets may not get as much bang for their buck by diverting additional assets to their investment accounts.

What Is Your Mortgage's Interest Rate?

If you're thinking about paying off your mortgage early, you'll need to know what your current interest rate is. Why? As we'll see in the next sections, understanding your rate will provide you the information you need to make an educated choice about whether or not overpaying is the best option for you.

It's all too easy to hear a friend claim they've saved thousands of dollars in interest costs and shortened their mortgage term, and assume it's the correct thing to do, too. However, you should do the figures yourself to be sure you're making the correct decision by paying off your mortgage early, and having your current mortgage rate handy is the first step.

What Is Your Investment Portfolio Like, And Where Do You Keep It?

In a similar vein, the mix of your financial assets and where you keep them are essential factors to consider. In the next decade, one might reasonably expect equities to yield 4% to 5% real (that is, inflation-adjusted) returns, providing an equity-heavy portfolio a decent chance of outperforming today's ultra low mortgage rates.

If you keep your assets in a tax-sheltered vehicle and/or receive matching funds on your contributions, the argument for investing in the market rather than prepaying the mortgage becomes much stronger. Portfolios that are heavily weighted in cash and fixed-income assets, particularly those that are fully taxable year to year, are less likely to outperform mortgage interest rates.

How Consistent Is Your Income?

Everyone should maintain an emergency fund, but some may need to raise their amounts to account for the unpredictability of their income. It's critical to consider how steady your income truly is. While all of our lives include an element of the unknown, for individuals who are self-employed or operate a company, this piece of the jigsaw takes on much more importance.

It's also not a good idea to think about how steady your income is in a subjective way. It's easy to get this incorrect, particularly if you're supplementing with debt from credit cards or other sources, so be completely honest with yourself and figure out your average wages over the past year to obtain a good estimate of your monthly income.

Once you've got it, you can start thinking about how things may evolve in the following months and years. Do you have any backup plans in place in case your most important customer goes bankrupt? Is your work really risk-free? Are there going to be layoffs at work?

While none of us has a crystal ball, we can frequently plan better with a little preparation, and this analysis of our circumstances may provide an unambiguous ‘no' to whether or not overpaying your mortgage is a smart idea, so it's worth the time and effort.

How Much Money Can You Save By Taking Advantage Of Your Mortgage Interest Deduction?

Many homeowners believe that keeping their mortgages is a good idea since they may deduct their interest payments on their taxes. However, as previously stated, since house loans are front-loaded toward interest payments, this deduction diminishes with time.

People who have been able to pay off a mortgage over a long period of time may be overestimating the amount of taxes they save by holding a mortgage, and itemizing deductions may not save them nearly as much as the standard deduction.

Will The Current Mortgage Allow You To Pay Down The Loan Early?

Other obligations, such as credit cards, should always be paid off first since the interest rates are usually greater. But, presuming you don't have any or have already paid them off, do you have a plan to pay off the loan early, and if so, by how much? If you're paying down a large portion of your debt and have a fixed rate loan, you'll typically have a restriction on how much you may pay, usually 10% of the total loan amount.

Then you'll almost certainly have to pay an Early Repayment Fee (ERC). There are usually no limitations once the introductory rate period expires, but it's a good idea to contact the lender or check your mortgage offer for additional information.

Another thing to keep in mind is that for the first few years (depending on how long you have your mortgage), the repayments will mostly be interest. This implies that the repayments will be mostly top-heavy, and if you choose to repay the mortgage with overpayments, the amount you owe will not have decreased much.

Is It Possible That Inflation May Help You In Paying Down Your Mortgage?

Here's something you may not be aware of, but it's crucial. A house could be purchased for $5000 only 20 years ago [compare that to a highly overpriced bottle of champagne in Mayfair today costing $35,000] This implies that over the course of 25 years, the money you pay on your repayment mortgage will be worth substantially less than what you bought for it.

Don't worry about inflation - the money you've been paying will be worth less in 25 years than it is now ($250K in 25 years will be worth less than $250K now). Pay down your mortgage if you're okay with paying down an amount in today's money that will be worth a fraction of what it is in 25 years.

Could You Receive A Greater Return On Your Investment Elsewhere?

If the cost of financing is extremely low, there is an opportunity cost of cash to consider for leveraging money for property investment, thus paying down your mortgage may or may not be the greatest pound for pound usage.

Consider if you'd rather save $200 or generate $500 in net cashflow each month by renting a home and reaping the benefits of capital growth. If you can borrow money at 2%+ and earn a 15%+ return on capital invested in a standard buy-to-let, you have some significant investment choices.

The purchase of a house is the single most significant personal expenditure that most individuals will ever make. Take the time to do the numbers before taking on such a large debt. After you've run the figures, think about your position and how you want to live in the future - not just now, but over the next decade or two. Before you buy a new house, think about not just how much it will cost to buy it, but also how your future mortgage payments will affect your life and budget. Then, obtain loan estimates from many different lenders for the kind of house you want to purchase to receive real-world information on the types of discounts you may get.

A mortgage is a valuable instrument for purchasing a home since it allows you to become a homeowner without putting down a hefty deposit. When you take out a mortgage, though, it's critical to comprehend the structure of your payments, which include not just the principle (amount borrowed), but also interest, taxes, and insurance. It estimates how long it will take you to pay off your mortgage and, in turn, how much it will cost you to finance your house purchase.