Understanding The Importance Of Jewelry Insurance And Appraisal

Jewelry holds not just monetary value but sentimental significance as well. Whether it’s a family heirloom, an engagement ring, or a valuable gemstone necklace, protecting these precious items is paramount. Jewelry insuranceand appraisal play a crucial role in safeguarding your investments and cherished memories.

Why Jewelry Insurance Matters

Jewelry, often cherished for both its monetary and sentimental value, deserves comprehensive protection. Understanding the reasons why jewelry insurance matters can be the key to ensuring your valuable pieces are safeguarded in every possible way.

Preserving Your Investments

Jewelry is not merely an accessory; it is an investment. Just like any financial investment, the value of jewelry can be subject to the unpredictable fluctuations of the market. Jewelry insurance acts as a robust shield, guarding your investments against unexpected disasters.

Whether it’s a stunning diamond ring or a vintage necklace, these pieces can be significantly impacted by theft, loss, or damage. Having comprehensive insurance ensures that your investments are financially protected, providing a safety net against the uncertainties of life.

Protecting Sentimental Value

Beyond the sparkle and shine, jewelry often carries immense sentimental worth. It might be an antique brooch handed down through generations, a wedding band that symbolizes a lifetime commitment, or a pendant that marks a significant life event. The emotional value attached to these pieces is immeasurable.

Jewelry insurance goes beyond the monetary value; it guarantees that even if the item is lost, stolen, or damaged, its sentimental value can be preserved. Insurance covers the costs of replacement or repair, ensuring that your cherished memories and family heirlooms remain intact, regardless of what fate may have in store.

Peace Of Mind

The knowledge that your precious jewelry is insured provides unparalleled peace of mind. It liberates you from the constant worry that accompanies owning high-value items. Whether you wear your jewelry daily, displaying it proudly to the world, or prefer to keep it securely locked in a safe, insurance offers a safety net against unforeseen circumstances.

This peace of mind allows you to enjoy your jewelry fully, wear it confidently, and pass it down to the next generation with the assurance that its legacy is protected. No longer plagued by fear, you can revel in the beauty of your jewelry collection, knowing that it is safeguarded by a robust insurance policy.

When And Why You Should Have Your Jewelry Appraised

Jewelry, with its timeless allure, often becomes an integral part of our lives, representing memories, milestones, and investments. However, the true value of these precious pieces can fluctuate over time due to changing market trends and economic factors. To ensure that your jewelry is adequately protected, having regular appraisalsis not just a suggestion; it's a vital step in safeguarding your investments and memories.

Appraising Your Jewelry - A Prudent Practice

Regular Appraisals For Existing Pieces

For jewelry you already own, it's wise to schedule appraisals every few years. The value of gems and precious metals is in a constant state of flux due to market demand, rarity, and other economic variables. Regular assessments ensure that your insurance coverage is up-to-date and that you won't be underinsured in case of a loss.

New Purchases And Inherited Gems

When you acquire a new piece of valuable jewelry, whether through a purchase or inheritance, it’s imperative to have it appraised promptly. This immediate assessment serves several critical purposes:

Accurate Replacement Value

Knowing the accurate replacement value of your new acquisition is crucial. In the unfortunate event of loss, theft, or damage, this appraisal acts as a benchmark for insurance claims. Having the item appraised right after acquisition guarantees that you are adequately covered from the very beginning.

Ensuring Authenticity

Professional appraisers not only evaluate the monetary value but also authenticate the jewelry. This verification is particularly essential for antique or heirloom pieces. It ensures that the jewelry is genuine, providing you with peace of mind and assurance about the authenticity of your collection.

Understanding Investment Potential

An appraisal by a certified gemologist can provide insights into the investment potential of your gems and jewelry. Understanding the market value and potential appreciation of your pieces allows for informed decisions regarding your jewelry portfolio and potential future investments.

Choosing A Qualified Appraiser

When seeking an appraisal, it’s crucial to choose a qualified and certified appraiser. Look for professionals affiliated with recognized organizations and possessing gemological certifications. Their expertise and experience ensure that the appraisal process is accurate, thorough, and trustworthy.

The Crucial Role Of Jewelry Appraisal

Jewelry appraisal is not merely a formality; it’s a meticulous process that plays a pivotal role in ensuring the security, authenticity, and financial protection of your precious pieces. Understanding the multifaceted role of jewelry appraisal can empower you as a jewelry owner, offering both peace of mind and confidence in your investments.

Determining The True Value

At its core, jewelry appraisal is the art and science of determining the true market value of a piece. This intrinsic value often varies from the initial purchase price due to several factors, including market fluctuations, craftsmanship, and the rarity of gemstones. A seasoned professional appraiser meticulously evaluates these elements, employing their expertise to establish an accurate value. This value forms the foundation of your jewelry’s worth, serving as a benchmark against which its financial and sentimental significance can be measured.

Insurance Premium Calculation

The relationship between jewelry appraisal and insurance premiums is a critical one. Insurance companies determine the premiums based on the appraised value of the jewelry. A precise and thorough appraisal ensures that you pay an appropriate premium, striking the delicate balance between adequate coverage and reasonable cost. Underestimating the value might leave you underinsured, leading to potential financial gaps in the event of a loss. Conversely, overestimating the value could result in unnecessary expenses. An appraisal, therefore, acts as a safeguard, ensuring that you invest in the right level of protection for your treasured items.

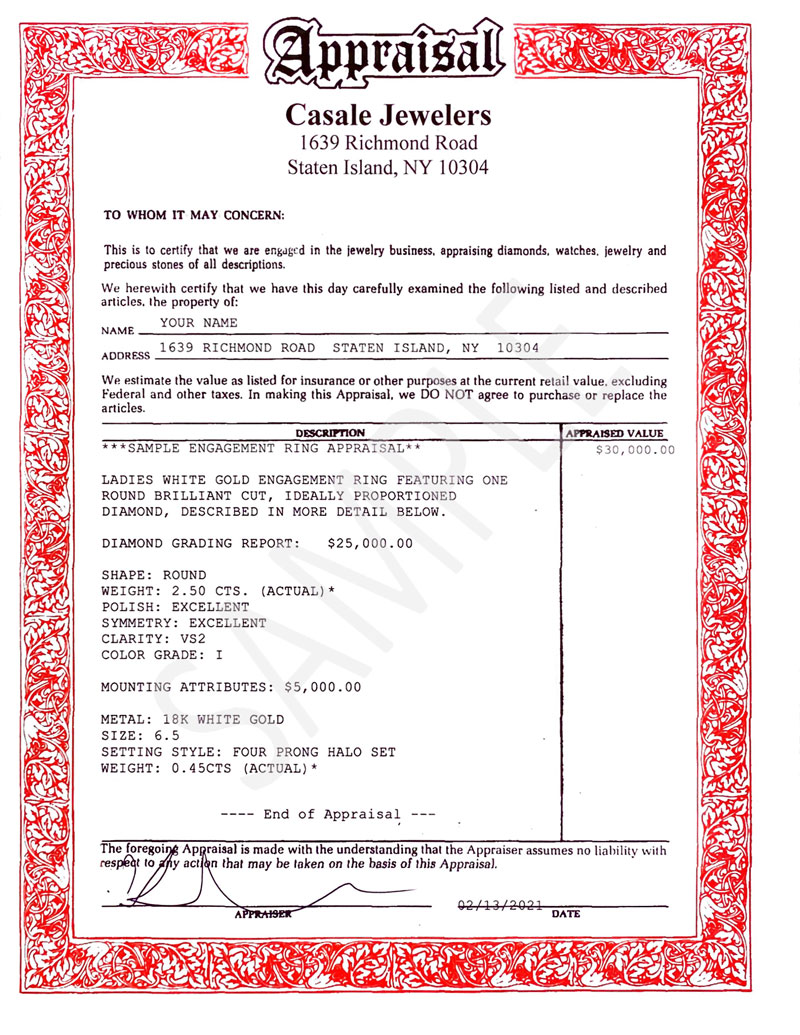

Proof Of Ownership And Claims Processing

In the unfortunate event of loss, theft, or damage, an appraisal serves as indisputable proof of ownership. Insurance companies require this meticulously documented evidence to process claims efficiently. A detailed appraisal, complete with comprehensive descriptions, high-quality photographs, and expert evaluations, simplifies the claims process significantly. This thorough documentation not only accelerates the resolution but also ensures that you receive the rightful compensation promptly.

Choosing The Perfect Jewelry Insurance

Selecting the right jewelry insurance is as crucial as the pieces you own. It’s not just about protecting your investments; it's about ensuring peace of mind and a sense of security.

Research And Comparison

Before diving into any insurance agreement, arm yourself with knowledge. Research and compare policies from various providers. Not all insurance plans are created equal; each comes with its own set of features and limitations. Investigate different insurance companies, their reputation, customer reviews, and their track record in handling jewelry-related claims.

Comprehensive Coverage

Look for policies that provide coverage for a myriad of scenarios. Your insurance should safeguard your jewelry against theft, loss, damage, and even disappearance. Comprehensive coverage ensures that, regardless of the unfortunate circumstances, your investments are protected. Be wary of policies that exclude certain situations, as these gaps might lead to significant financial losses in the future.

Evaluate Deductibles And Coverage Limits

Deductibles and coverage limits are the backbone of any insurance policy. Evaluate deductibles – the amount you pay before the insurance kicks in. A balance must be struck; too high a deductible might burden you with excessive out-of-pocket costs, while too low might lead to higher premium payments. Likewise, assess the coverage limits – the maximum amount the insurance company will pay in case of a claim. Ensure these limits align with the value of your jewelry collection.

Seamless Claims Process

A seamless claims process is essential during stressful times. Inquire about the insurance company's procedure for filing claims. Does it involve a convoluted paperwork process or a straightforward online system? Understanding the ease with which you can file a claim and the speed at which it will be processed is paramount. Efficient claims handling guarantees a swift resolution, allowing you to recover and replace your cherished items without unnecessary delays.

Jewelry Appraisal Requirements

Most insurance policies necessitate a jewelry appraisal to determine the accurate value of your items. Inquire about specific requirements related to appraisals. Ensure that your chosen appraiser and the appraisal itself meet the insurance company's criteria. The accuracy and thoroughness of the appraisal directly impact your coverage and subsequent claims. An appraisal that aligns with the insurer's guidelines provides a solid foundation for your insurance protection.

Special Considerations For High-Value Jewelry

High-value jewelry items, often comprising exquisite diamonds, rare gemstones, and intricate designs, require a tailored approach when it comes to insurance.

Unique Coverage Options

When it comes to high-value jewelry, standard insurance policies might not suffice. Specialized coverage options tailored for high-value items are essential. These options often include scheduled or blanket coverage. Scheduled coverage allows you to specifically list each high-value piece with its appraised value, ensuring comprehensive protection for each item. On the other hand, blanket coverage provides a total coverage limit for all valuable items, allowing more flexibility in managing your insurance portfolio.

Enhanced Security Measures

High-value jewelry demands enhanced security measures to mitigate the risk of theft or loss. Insurance companies may require specific security protocols to be in place, such as sophisticated alarm systems, safes meeting certain specifications, and even periodic security audits. Implementing these security measures not only fulfills insurance requirements but also acts as a deterrent, reducing the likelihood of theft.

Comprehensive Appraisal Requirements

Accurate and detailed appraisals are fundamental for high-value jewelry insurance. In addition to the standard appraisal factors like gemstone quality, craftsmanship, and market value, insurance appraisals for high-value items need to be thorough and meticulous. Appraisers must be experienced in evaluating rare and precious stones, intricate designs, and historical or antique pieces. Detailed documentation, including high-resolution photographs and comprehensive descriptions, is crucial. Moreover, these appraisals should be updated periodically to reflect market fluctuations and changes in the item's value over time.

Coverage For Travel And Special Events

High-value jewelry often accompanies you to special events or might be worn during travels. Special considerations are necessary to ensure these items are covered even when you're on the move. Travel insurance endorsements or additional riders can be added to your policy to provide coverage beyond the confines of your home. These endorsements are vital, especially if you frequently travel or attend events where your valuable jewelry is an essential part of your attire.

Evaluating Deductibles And Premiums

Considering the high value of the jewelry, deductibles and premiums must be evaluated carefully. While higher deductibles can lower premium costs, they also mean a higher out-of-pocket expense in the event of a claim. Balancing these factors is crucial; you want premiums that are affordable yet ensure comprehensive coverage without leaving you financially burdened during a claim.

Understanding Depreciation And Agreed Value In Jewelry Insurance

Jewelry, as an asset, is not immune to the passage of time and wear. Understanding how depreciation and agreed value factor into jewelry insurance is vital for ensuring that your valuable items are adequately protected.

Depreciation

Depreciation refers to the decrease in the market value of an item over time. In the context of jewelry, it accounts for factors such as wear and tear, changes in fashion trends, and the natural aging of materials. Most standard insurance policies factor in depreciation when determining the payout for a claimed item. As a result, older pieces of jewelry might receive a lower payout compared to their original purchase price.

However, the extent of depreciation can vary based on the type of jewelry and the insurance policy. High-value items such as diamonds and certain gemstones might depreciate at a different rate than common jewelry pieces. It’s crucial to comprehend how your insurance policy addresses depreciation to avoid potential surprises during a claim.

Agreed Value

In contrast to depreciation, agreed valueinsurance policies offer a distinct advantage. With agreed value policies, you and the insurance provider agree upon a specific value for the insured item at the time the policy is written. This agreed-upon value remains fixed, regardless of market fluctuations, fashion trends, or the passage of time. In the event of a covered loss, the agreed value ensures that you receive the predetermined sum, allowing you to replace the lost or damaged item with a similar piece without any depreciation deductions.

Having an agreed value policy can be especially beneficial for high-value and unique jewelry pieces. It provides a level of certainty, guaranteeing that your investment is fully protected, and you won’t face any surprises regarding the payout amount during a claim.

The Role Of Appraisals In Depreciation And Agreed Value

Accurate and up-to-date jewelry appraisals play a pivotal role in both scenarios. For depreciation-based policies, the appraisal establishes the current market value of the jewelry, helping the insurance company determine the appropriate payout. For agreed value policies, the appraisal serves as the basis for the agreed-upon value, ensuring that the item is properly valued at the time of policy issuance.

Understanding the nuances of depreciation and agreed value in jewelry insurance empowers you to make informed decisions when choosing an insurance policy. By ensuring that your policy aligns with the value of your jewelry, you can enjoy the peace of mind that comes with knowing your investments are safeguarded, regardless of market fluctuations or the passage of time.

For more insights into factors affecting gemstone prices, check out this informative article on Factors That Affect the Price of Pukhraj.

Jewelry Insurance - FAQs

Is It Worth It To Get Jewelry Insurance?

Whether or not to get jewelry insurance depends on the value and sentimental importance of your jewelry pieces. If you own high-value items or items with significant sentimental value, such as engagement rings, family heirlooms, or rare gemstones, getting jewelry insurance is undoubtedly worth it.

Jewelry insurance provides financial protection in case of theft, loss, damage, or other unforeseen circumstances. It offers peace of mind, allowing you to wear and enjoy your jewelry without worrying about potential losses. Additionally, the cost of jewelry insurance is typically a fraction of the value of the items being insured, making it a worthwhile investment to safeguard your valuable possessions.

What Kind Of Insurance Do You Need For Jewelry?

When it comes to insuring jewelry, there are a few options to consider:

- Rider or Endorsement on Homeowner’s or Renter’s Insurance:You can often add a special jewelry rider or endorsement to your existing homeowner’s or renter’s insurance policy. This option provides additional coverage specifically for your jewelry items. However, be aware that there might be coverage limits and deductibles.

- Standalone Jewelry Insurance:Standalone jewelry insurance policies are offered by specialized insurance providers. These policies are tailored specifically for jewelry, offering comprehensive coverage with higher limits and fewer restrictions compared to typical homeowner’s or renter’s insurance riders. Standalone policies often cover a broader range of situations, including accidental loss.

- Scheduled Jewelry Insurance:With scheduled insurance, each piece of jewelry is individually listed in the policy along with its appraised value. This option provides precise coverage for each item and is a good choice for high-value items.

What Does Jewelry Insurance Cover?

Jewelry insurance typically covers various situations, including but not limited to:

- Theft:If your jewelry is stolen, insurance can provide coverage to replace the stolen items.

- Loss:Some policies cover accidental loss, even if you simply misplaced your jewelry.

- Damage:Jewelry insurance can cover the cost of repairs if your items are damaged, be it a cracked gemstone or a broken necklace.

- Disappearance:Unlike standard policies, some jewelry insurance policies cover mysterious disappearance, which means if you simply can’t find your jewelry, you are still covered.

It’s crucial to read the policy documents carefully and understand the terms, conditions, and limitations of your jewelry insurance coverage. Additionally, having a detailed appraisal and keeping records of your jewelry can facilitate the claims process in case you need to file a claim.

Conclusion

In the world of jewelry, insurance and appraisal are your best allies. They offer financial protection and emotional security, allowing you to enjoy your valuable pieces without constant worry. Understanding the importance of both these aspects ensures that your jewelry remains not just an ornament but a cherished and safeguarded treasure.