Blockchain Mortgage Lending - A New Era In Home Financing

Mortgage lending has been a staple of the financial industry for centuries. However, the process of getting a mortgage can be cumbersome, time-consuming, and fraught with potential errors and fraud. With the advent of blockchain mortgage lendingindustry is poised for a significant transformation. In this article, we will explore how blockchain technology can revolutionize the mortgage lending process.

What Is Blockchain?

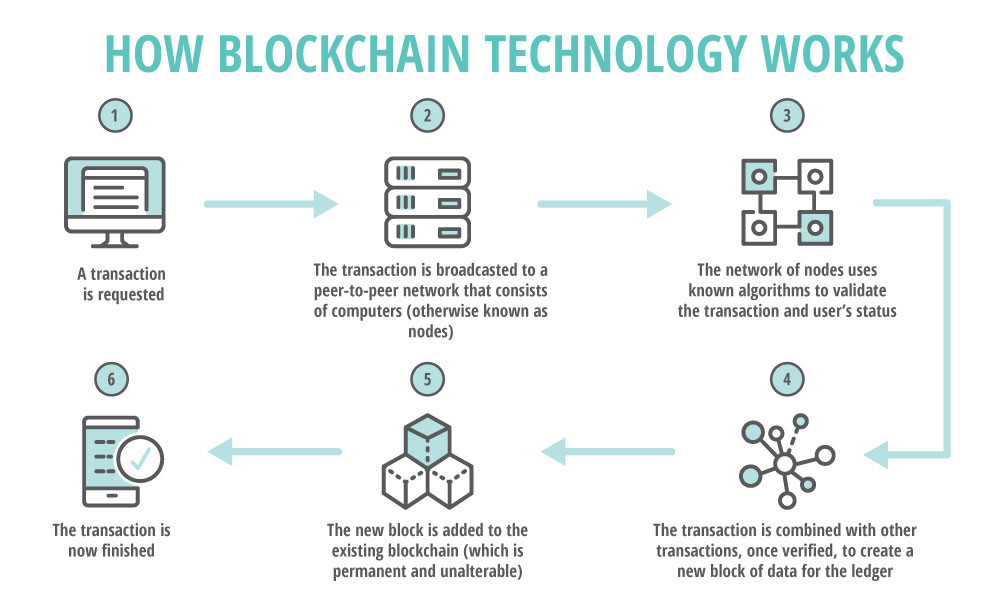

Blockchain is a distributed ledger technology that allows multiple parties to share a secure, tamper-proof database. Each transaction is recorded as a block, which is verified by a network of nodes and added to the existing chain. Once a block is added, it cannot be modified or deleted, making the blockchain an immutable record of all transactions, much processing is needed for this process as noted in a guidein Novabach.

How Blockchain Can Transform Mortgage Lending

The mortgage lending process is ripe for disruption, and blockchain technology offers several potential benefits, including:

Increased Transparency

One of the biggest challenges of the mortgage lending process is the lack of transparency. Borrowers often have no way of knowing how their loan is being evaluated, what criteria are being used, or why they were denied. With a blockchain-based mortgage lending system, all parties involved in the transaction have access to the same information, ensuring transparency and reducing the risk of fraud.

Faster Processing Times

The mortgage lending process can take weeks or even months, leading to frustration and uncertainty for borrowers. Blockchain technologycan automate many of the manual processes involved in mortgage lending, including document verification and credit checks, reducing processing times and streamlining the process for borrowers and lenders.

Lower Costs

Mortgage lending is an expensive process, with fees for appraisals, credit checks, and other services adding up quickly. By leveraging blockchain technology, lenders can reduce the need for third-party intermediaries, lowering costs and increasing efficiency.

Improved Security

Mortgage lending involves sensitive personal and financial information, making it a prime target for hackers and other cybercriminals. With a blockchain-based system, all data is encrypted and stored securely on a distributed ledger, reducing the risk of data breaches and identity theft.

Real-World Applications Of Blockchain Mortgage Lending

Several companies are already exploring blockchain-based mortgage lending solutions. For example, Figure Technologies, a fintech company that uses blockchain technology to originate, finance, and sell home equity loans, recently launched a new platform that allows borrowers to complete the entire mortgage application process online. The platform uses blockchain technology to automate many of the manual processes involved in mortgage lending, reducing processing times and costs.

Another example is Provenance, a blockchain-based platform that streamlines the mortgage lending process for originators, investors, and servicers. Provenance leverages blockchain technology to provide a secure, transparent, and efficient system for loan origination, funding, and servicing.

Future Of Blockchain Mortgage Lending

The future of blockchain mortgage lending looks promising, with many companies already exploring the technology's potential. The use of blockchain technology could lead to a significant reduction in the costs and time associated with mortgage lending, making the process more accessible and efficient for borrowers. Additionally, blockchain technology could improve the security and transparency of the mortgage lending process, reducing the risk of fraud and increasing trust between lenders and borrowers.

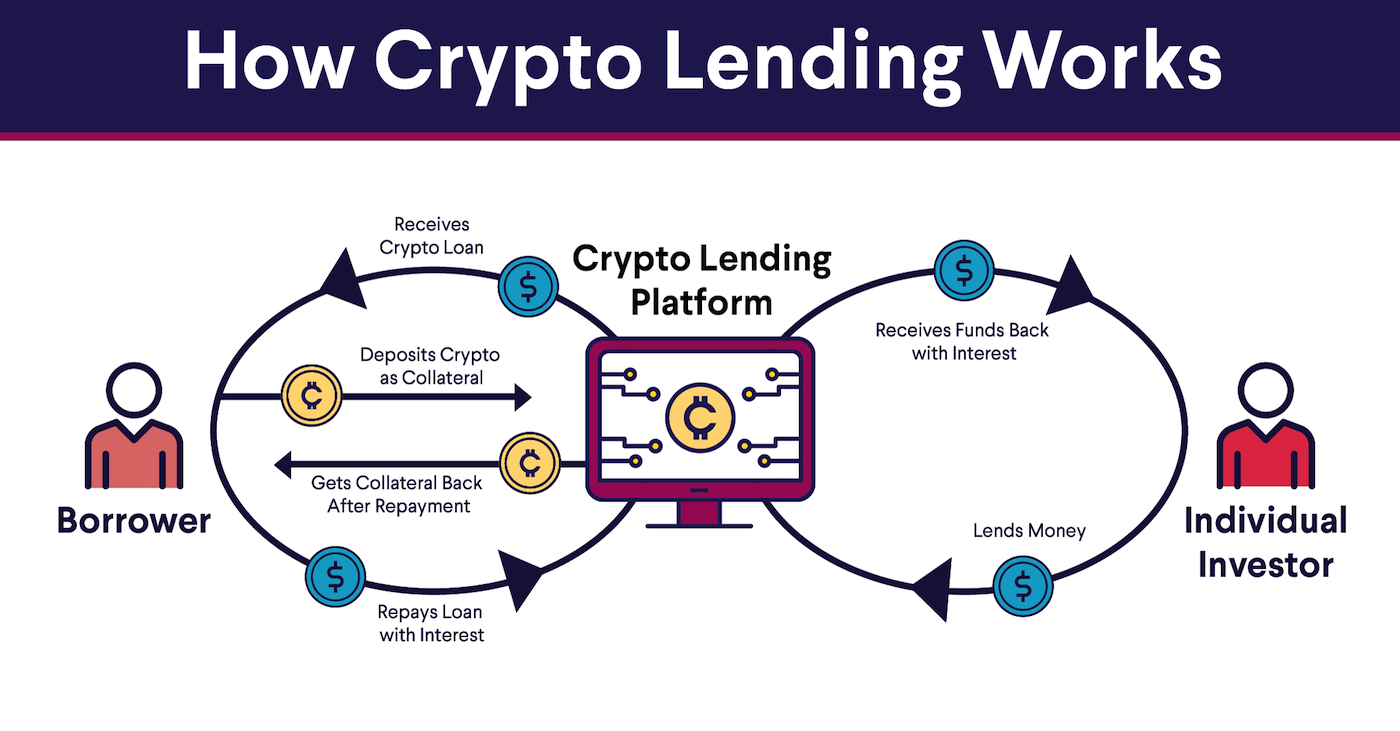

Moreover, blockchain technology could also lead to the creation of new lending models, such as peer-to-peer lending, where borrowers can obtain loans directly from investors without the need for intermediaries. This could create new opportunities for borrowers who may not meet the strict requirements of traditional lenders.

Potential Impact On The Real Estate Industry

The impact of blockchain technology on the real estate industry goes beyond just mortgage lending. Real estate transactions involve multiple parties, including buyers, sellers, agents, and lenders, and require extensive documentation and verification. With blockchain technology, these transactions can be streamlined and made more efficient, reducing the time and costs associated with real estate transactions.

Moreover, the use of smart contracts, a feature of blockchain technology, can automate the execution of real estate contracts, reducing the need for intermediaries and improving efficiency. Smart contracts can also ensure that all parties involved in the transaction adhere to the terms of the contract, reducing the risk of disputes and increasing trust between parties.

Challenges And Risks

While the benefits of blockchain technology for the mortgage lending and real estate industries are significant, there are also challenges and risks to consider. One of the biggest challenges is the lack of standardization in the industry, making it difficult to create a universal blockchain-based system that all parties can use. Additionally, the regulatory and compliance landscape is constantly evolving, and companies will need to ensure they adhere to all relevant regulations.

Moreover, the adoption of blockchain technology will require significant investment in infrastructure and training, and companies will need to ensure they have the necessary resources to implement the technology effectively.

For example, the lack of standardization in the industry can make it difficult to create a universal blockchain-based systemthat all lenders and borrowers can use. Additionally, there are regulatory and compliance issues to consider, as well as potential privacy concerns.

The Role Of Collaboration In Blockchain Adoption

The adoption of blockchain technology in the mortgage lending and real estate industries will require collaboration between different stakeholders, including lenders, real estate agents, investors, regulators, and technology providers. Collaboration will be essential in creating a standardized system that all parties can use and ensuring that the technology is adopted in a way that meets the needs of all stakeholders.

Moreover, collaboration will be essential in addressing the challenges and risks associated with blockchain adoption. Companies will need to work together to create best practices for implementing blockchain technology, ensuring regulatory compliance, and mitigating risks such as cyber attacks and fraud.

Potential Applications In Other Industries

While the focus of this article has been on the potential impact of blockchain technology on the mortgage lending and real estate industries, the technology has applications in other industries as well. For example, blockchain technology could be used in supply chain management to improve transparency and traceability, or in healthcare to secure patient data and improve the efficiency of medical records management.

Moreover, the use of blockchain technology in different industries could create new opportunities for collaboration and innovation, leading to the development of new business models and the creation of new markets.

People Also Ask

Will Blockchain Revolutionize Mortgage Lending?

Blockchain has the potential to revolutionize the mortgage lending industry by offering increased transparency, faster processing times, lower costs, and improved security. While there are challenges and risks to consider, the benefits of a blockchain-based system are significant, and more companies are exploring blockchain-based solutions for mortgage lending.

How Is Blockchain Used In Lending?

Blockchain technology can be used in lending to create a decentralized, secure, and transparent system that reduces the need for intermediaries and improves efficiency. Some of the ways in which blockchain technology is used in lending include creating smart contracts, verifying borrower identity, facilitating peer-to-peer lending, and creating a decentralized ledger to track loan transactions.

What Is Blockchain In Mortgage?

Blockchain in mortgage refers to the use of blockchain technology in the mortgage lending industry. Blockchain technology can be used to create a secure and transparent mortgage lending process, reducing the need for intermediaries and improving efficiency. Additionally, blockchain technology can be used to create new lending models, such as peer-to-peer lending, that provide borrowers with alternative lending options.

Conclusion

Blockchain technology has the potential to transform the mortgage lending industry, offering increased transparency, faster processing times, lower costs, and improved security. While there are still challenges and risks to consider, the benefits of a blockchain-based system are too significant to ignore.

As more companies explore blockchain-based mortgage lending solutions, we are likely to see significant advancements in the industry in the coming years.

Moreover, the potential applications of blockchain technology in other industries offer significant opportunities for innovation and collaboration, leading to the development of new business models and the creation of new markets. As more companies explore blockchain-based solutions, we are likely to see significant advancements in multiple industries, leading to a more accessible, efficient, and secure global economy.