A Comprehensive Guide About Mortgage Basics For Homebuyers

When you're ready to buy a home, understanding mortgages basicsis like having a key to your new front door. A mortgage is not just a loan; it's a crucial element in making homeownership possible for millions of people. Let's dive into the basics of mortgages and why they're so important for homebuyers.

Importance Of Understanding Mortgage Basics

Grasping the basics of mortgages is essential for several reasons. First, it helps you make informed decisions about one of the biggest purchases you'll ever make. Second, understanding how mortgages work can save you money by helping you choose the right loan for your situation. Lastly, it can reduce the stress and confusion that often come with the home-buying process.

Overview Of The Mortgage Process

The mortgage process involves several steps, starting with pre-approval, where you find out how much you can borrow. Next, you'll shop for a home within your budget and make an offer. Once the offer is accepted, you'll formally apply for a mortgage. The lender will then review your application—a process known as underwriting—to decide whether to approve your loan. If approved, you'll move on to closing, where you'll sign a heap of paperwork, pay closing costs, and finally, get the keys to your new home. After closing, you'll begin making regular mortgage payments, typically on a monthly basis.

Understanding mortgages is a journey, and this guide is your map. As we explore the landscape of home loans, you'll gain the knowledge and confidence needed to navigate the path to homeownership.

Key Mortgage Terms Explained

When diving into the world of home buyingand mortgages, you'll encounter a variety of terms that are crucial to understanding how mortgages work. Here's a breakdown of some key mortgage terms every homebuyer should know.

Principal And Interest

The principal is the amount of money you borrow to purchase your home. It's the base amount that you'll need to repay over the life of the loan. Interest, on the other hand, is the cost you pay to the lender for borrowing that money. It's typically expressed as a percentage rate.

When you make a mortgage payment, it usually includes a portion that goes toward reducing the principal and another portion that covers the interest. In the early years of a mortgage, the interest portion of the payment is higher, but as you pay down the principal, the interest charges decrease, and more of your payment goes toward reducing the principal.

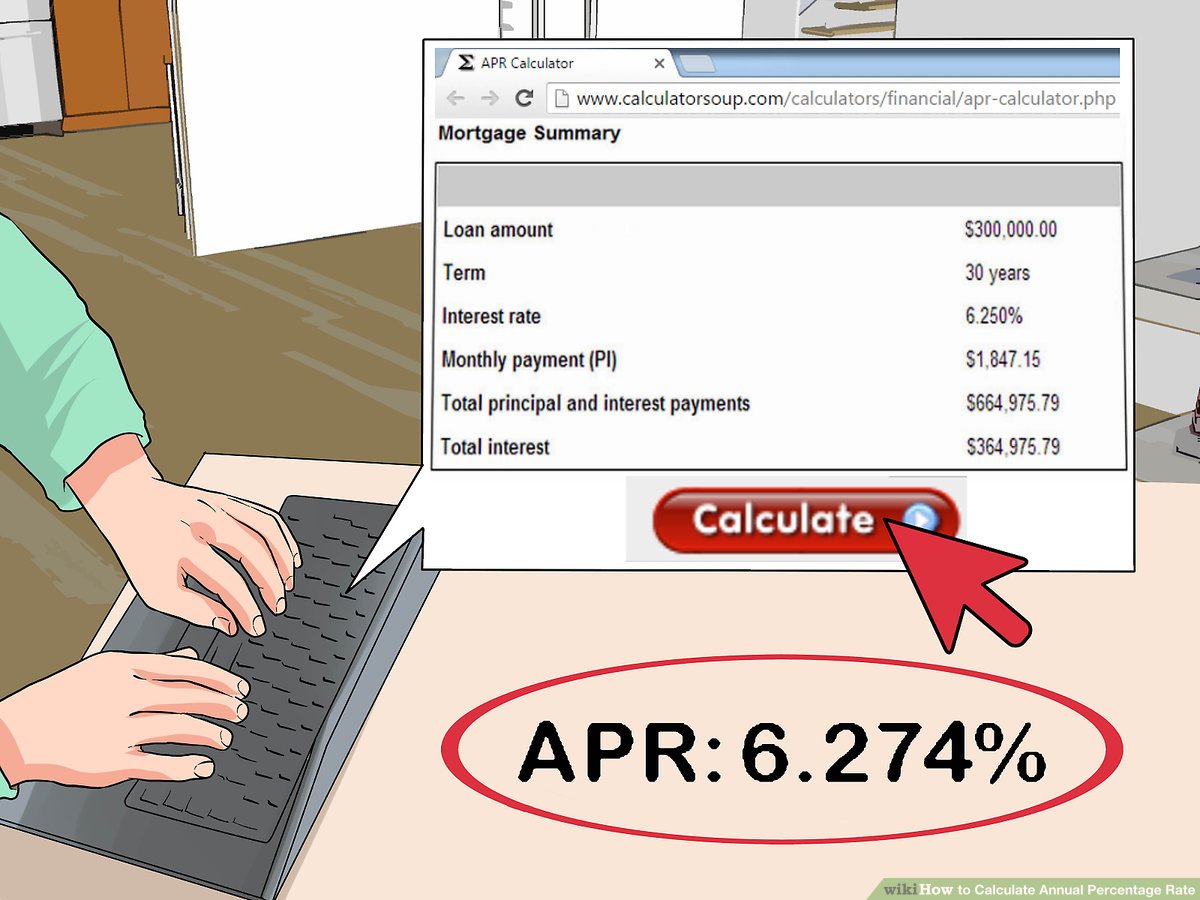

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a broader measure of the cost of borrowing money than the interest rate alone. The APR includes the interest rate, points, broker fees, and certain other credit charges that the borrower is required to pay. It's expressed as a yearly rate, and it's important because it gives you a more complete picture of how much you'll actually pay annually for your loan.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is a type of insurance that protects the lender if you stop making payments on your loan. If you're making a down payment of less than 20% of the home's purchase price, lenders typically require PMI. This insurance can be a monthly fee added to your mortgage payment, and it's important to factor this into your budget when considering how much house you can afford.

Equity And Loan Amortization

Equity refers to the portion of your home that you actually own. It's the difference between the value of your home and the amount you still owe on your mortgage. As you make payments and the principal amount decreases, your equity increases.

Loan amortization is the process of paying off a debt over time with regular payments. An amortization schedule shows how much of each payment goes to interest and how much goes to reducing the principal. Over the life of the loan, the interest portion decreases, and the principal portion increases, which means you build equity at an increasing rate as time goes on.

Understanding these terms is essential for any homebuyer. They are the building blocks of your mortgage and will affect how much you pay over time, how much equity you build, and your overall financial stability as a homeowner. With this knowledge, you'll be better equipped to make informed decisions and choose the right mortgage for your situation.

Types Of Mortgages Available

When you're ready to buy a home, understanding the different types of mortgages available is crucial. Each type of mortgage comes with its own set of rules, interest rates, and payment plans. Here's a breakdown of the most common types of mortgages to help you find the one that's right for you.

Fixed-Rate Mortgages

Fixed-rate mortgages are one of the most popular choices for homebuyers. With this type of mortgage, the interest rate stays the same for the entire term of the loan, which can range from 10 to 30 years. This means your monthly mortgage payments are predictable and won't change over time, making it easier to budget for the long term.

- Higher initial interest rates compared to adjustable-rate mortgages.

- Less flexibility if interest ratesfall.

- Stability in monthly payments.

- Protection from rising interest rates.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) have interest rates that can change over time. Typically, ARMs start with a lower interest rate than fixed-rate mortgages, but after a set period, the rate can go up or down based on market conditions. This initial period can be as short as one month or as long as several years.

- Uncertainty in future payment amounts.

- Risk of significantly higher payments if interest rates rise.

- Lower initial interest rates, which means lower initial monthly payments.

- Potential for interest rates and payments to decrease if market rates fall.

Government-Backed Loans (FHA, VA, USDA)

Government-backed loans are designed to help certain homebuyers get into a home with more favorable terms. These include:

- FHA Loans: Insured by the Federal Housing Administration, FHA loans allow for lower down payments and are more accessible to those with less-than-perfect credit.

- VA Loans: Guaranteed by the Department of Veterans Affairs, VA loans are available to veterans and active military members. They often require no down payment.

- USDA Loans: Offered by the United States Department of Agriculture, these loans are for rural homebuyers and usually require no down payment.

Interest-Only And Reverse Mortgages

Interest-only mortgagesallow the borrower to pay only the interest on the loan for a set period, usually 5 to 10 years. After this period, the borrower must start paying off the principal, which can result in a significant increase in monthly payments.

Reverse mortgagesare available to homeowners aged 62 and older, allowing them to convert part of their home equity into cash without having to sell their home or make monthly payments. The loan is repaid when the homeowner moves out, sells the home, or passes away.

- Potential for large payment increases with interest-only mortgages.

- Decrease in equity over time with reverse mortgages.

- Lower initial payments for interest-only mortgages.

- Access to home equity for retirees with reverse mortgages.

Choosing the right mortgage can be a complex decision. It's important to consider your current financial situation, your long-term goals, and how comfortable you are with the possibility of your payments changing over time. By understanding the basics of each mortgage type, you can make an informed decision that aligns with your homebuying needs.

How To Choose The Right Mortgage

Selecting the appropriate mortgage is a pivotal decision in the homebuying process, one that can have enduring financial implications. To make a well-informed choice, it's essential to grasp your financial situation, assess various mortgage options, and comprehend how your credit score influences your mortgage eligibility. For valuable insights into navigating the complexities of digital marketing in the entertainment industry, check out this resource on digital marketing.

Assessing Your Financial Situation

Before you start looking at houses or comparing mortgage options, take a close look at your finances. This means evaluating your income, debts, savings, and investment accounts. Consider the following:

- Monthly Income: How much money do you bring in each month? This will help determine how much you can afford to pay towards a mortgage.

- Debt-to-Income Ratio (DTI): This is the percentage of your monthly income that goes towards paying debts. Lenders typically prefer a DTI below 36%.

- Down Payment: The larger your down payment, the less you'll need to borrow. A down payment of 20% or more can also help you avoid paying PMI.

- Emergency Fund: It's important to have savings set aside for unexpected expenses. Make sure you can afford a mortgage while maintaining this safety net.

Comparing Interest Rates And Terms

Interest rates and the terms of a mortgage can greatly affect the total cost over the life of the loan. Here's what to consider:

- Fixed vs. Adjustable Rates: Fixed-rate mortgages keep the same interest rate throughout the term, while adjustable-rate mortgages (ARMs) can change. Assess the risk and potential future rate increases if you're considering an ARM.

- Loan Term: Mortgages are commonly available in 15-year and 30-year terms. A shorter term means higher monthly payments but less interest paid over time.

- Comparison Shopping: Don't settle for the first mortgage offer. Get quotes from multiple lenders to find the best rate and terms for your situation.

Understanding Fees And Points

Mortgages come with various fees and points that can add to the cost of the loan. Here's what to look out for:

- Origination Fees: These are charged by the lender for processing the mortgage application.

- Closing Costs: These are fees paid at the closing of a real estate transaction. They can include appraisal fees, title insurance, and more.

- Points: Points are fees paid directly to the lender at closing in exchange for a reduced interest rate. One point typically equals 1% of the loan amount.

The Role Of Credit Scores In Mortgage Approval

Your credit score is a key factor in determining whether you'll be approved for a mortgage and at what interest rate. Here's how it works:

- Higher Scores Mean Better Rates: A high credit score can help you secure a lower interest rate, which means lower monthly payments.

- Improving Your Credit Score: Paying bills on time, reducing debt, and correcting any errors on your credit report can help improve your score.

- Understanding Credit Reports: Check your credit report before applying for a mortgage to ensure all information is accurate.

Deliberating on these factors allows you to select a mortgage that aligns with your financial situation and long-term objectives. Keep in mind that a mortgage constitutes a lasting commitment, and the decisions you make at present will resonate with your financial well-being in the years ahead. For additional insights into unique and historical properties hitting the market, explore this captivating article from Commercial Architecture Magazine, 900-year-old castle in the UK.

The Mortgage Application And Approval Process

Navigating the mortgage application and approval process can be a complex journey for many homebuyers. Understanding each step is crucial to securing a mortgage that fits your financial situation and getting you closer to owning your dream home.

Preparing Necessary Documentation

When you're ready to apply for a mortgage, you'll need to gather a variety of documents. Lenders require this information to verify your financial status and determine your ability to repay the loan. Here's a checklist of what you might need:

- Proof of Income: This includes recent pay stubs, tax returns from the past two years, and if applicable, additional documentation for bonuses, alimony, or child support.

- Asset Documentation: Bank statements and investment account statements prove that you have funds for the down payment and closing costs.

- Credit Information: Although lenders will pull your credit report, you should have information on hand about current debts.

- Employment Verification: Lenders may contact your employer to verify employment and salary.

- Identification: A government-issued ID and Social Security number are necessary for your credit report.

Organizing these documents beforehand can expedite the application process and help avoid delays.

The Role Of Lenders And Underwriting

After submitting your application, it enters the underwriting stage. Underwritingis where lenders assess the risk of lending to you based on your credit, capacity to repay, and collateral. During this phase, underwriters may request additional information or clarification on the documents provided.

The lender's decision will be one of the following:

- Approval: Your loan is approved, and you can proceed to closing.

- Denial: If your application is denied, lenders are required to provide an explanation.

- Conditional Approval: Sometimes, lenders approve the loan with conditions that you must meet before final approval.

Understanding the underwriter's role and responding promptly to their requests can help ensure a smoother process.

Closing On A Mortgage

Closing is the final step in the home buying and mortgage process. At closing, you'll sign a variety of legal documents, finalize your loan, and take ownership of the property. Here's what to expect:

- Closing Disclosure Review: You'll receive a Closing Disclosure at least three days before closing. This document outlines the final terms of your loan and closing costs.

- Final Walkthrough: A final inspection of the property to ensure everything is in order.

- Signing Documents: This includes the mortgage note, which outlines your obligation to repay the loan, and the mortgage or deed of trust, which secures the note.

- Paying Closing Costs: You'll need to pay any remaining fees and closing costs, which can include appraisal fees, title insurance, and attorney fees.

Be prepared to spend a few hours at the closing table and bring a cashier's check or arrange a wire transfer for the closing costs.

Managing Your Mortgage Post-Closing

Once you've closed on your mortgage, it's important to manage it effectively. Keep these points in mind:

- First Payment: Know when your first mortgage payment is due and consider setting up automatic payments.

- Escrow Account: If you have an escrow account, your property taxes and homeowners insurance will be included in your monthly payment.

- Extra Payments: Making extra payments can reduce the amount of interest you pay over the life of the loan and can shorten your loan term.

- Refinancing: If interest rates drop or your financial situation improves, refinancing could be a beneficial option.

Mortgage Basics - FAQs

What Is The Basic Idea Of Mortgage?

The basic idea of a mortgage is a financial arrangement where a borrower obtains a loan from a lender to purchase real estate. The property itself serves as collateral for the loan, and the borrower agrees to repay the loan amount over a specified period, usually through regular monthly payments.

What Are The Three Elements Of A Mortgage?

The three essential elements of a mortgage are:

- Principal: The loan amount borrowed for the property purchase.

- Interest: The cost of borrowing, expressed as a percentage of the loan amount.

- Collateral: The property itself, which acts as security for the loan. If the borrower fails to repay, the lender may take ownership through foreclosure.

Is A Mortgage A Loan?

A mortgage is a type of loan. It is a specific type of loan used for the purpose of buying real estate. In a mortgage, the property being financed serves as collateral for the loan, and the borrower repays the borrowed amount over time, typically with interest.

Conclusion

Staying on top of your mortgage payments and understanding how they fit into your overall financial picture is essential for long-term homeownership success.

By familiarizing yourself with the mortgage application and approval process, you can approach this significant financial milestone with confidence. Remember, every step you take brings you closer to the keys to your new home. Keep communication open with your lender, stay organized, and before you know it, you'll be stepping through the doorway of your future.