Loan Amortization - How It Works & How To Use It To Your Advantage

Understanding how loans work can save borrowers thousands of dollars over time. Loan amortization is one of the most important concepts in personal and business finance, affecting mortgages, auto loans, and other long-term debts. Knowing how amortization impacts interest payments and principal reduction can help borrowers make informed financial decisions.

This article explains everything you need to know about loan amortization, including how it works, different types of amortized loans, calculation methods, and strategies to save money on interest.

What Exactly Is Loan Amortization?

Loan amortization refers to the process of gradually paying off a loan through fixed monthly payments. Each payment consists of two parts:

- Principal: The portion of the payment that reduces the loan balance.

- Interest: The cost of borrowing money from the lender.

Over time, the percentage of the payment that goes toward the principal increases, while the interest portion decreases. This structured repayment plan ensures the loan is fully paid off by the end of its term.

Key Features Of Loan Amortization

- Predictable monthly payments.

- Interest is front-loaded (higher at the beginning, lower toward the end).

- Helps borrowers build equity in assets like homes and vehicles.

How Loan Amortization Works

Amortization relies on a formula that calculates how much of each payment goes toward interest vs. principal. Here’s a simplified breakdown:

The Amortization Formula

The monthly payment (PMT) on a fixed-rate loan is calculated using:

PMT = P× r(1+r)n /(1+r)n - 1

Where:

- P= Principal loan amount

- r= Monthly interest rate (annual rate ÷ 12)

- n= Total number of payments

How Payments Are Split

- Early in the loan, interest dominates (since it’s calculated on the remaining balance).

- Later in the loan, principal reduction accelerates.

Example:

- Loan: $200,000 at 4% for 30 years

- Monthly Payment: $954.83 (fixed)

First Payment Breakdown:

- Interest: $666.67

- Principal: $288.16

Final Payment Breakdown:

- Interest: $3.18

- Principal: $951.65

Takeaway:You pay far more interest early on, which is why extra payments early in the loan save significant money.

Types Of Amortizing Loans

1. Mortgage Loans

Mortgage loans are among the most common types of amortizing loans, typically structured over long repayment periods of 15 or 30 years. Borrowers make fixed monthly payments that gradually reduce the loan balance while covering interest costs.

These loans can have either fixed interest rates, where payments remain the same throughout the term, or adjustable rates, which fluctuate based on market conditions. Because mortgages involve significant loan amounts and extended repayment periods, they are often the most complex form of amortization that individuals manage in their lifetime.

2. Auto Loans

Auto loans follow a structured amortization schedule, generally spanning between three and seven years. Borrowers make fixed monthly payments, with a larger portion of the initial payments going toward interest. As the loan matures, a greater share of each payment is applied to the principal balance.

Unlike mortgages, auto loans have shorter repayment periods, allowing borrowers to pay off their vehicles faster while avoiding excessive interest costs. However, since cars depreciate over time, it is crucial to choose a loan term that does not exceed the vehicle's lifespan.

3. Personal Loans

Personal loans are typically unsecured loans that come with shorter repayment terms, often ranging from one to five years. These loans follow a straightforward amortization structure, with fixed monthly payments that gradually reduce the outstanding balance.

Unlike mortgages or auto loans, which are secured by collateral, personal loans rely on the borrower's creditworthiness, often resulting in slightly higher interest rates. They are commonly used for consolidating debt, covering medical expenses, or financing large purchases, offering flexible repayment terms that suit different financial needs.

4. Student Loans

Student loans have a unique amortization structure that differentiates them from other loan types. Unlike traditional amortizing loans, student loans often come with deferment periods, during which borrowers are not required to make payments while enrolled in school.

Once the repayment period begins, the loan follows an amortization schedule, but repayment terms can vary based on the borrower's financial situation. Federal student loans offer options such as income-driven repayment plans, which adjust monthly payments based on income levels, extending the amortization period but ensuring affordability.

Loan Amortization Schedule Vs. Loan Term

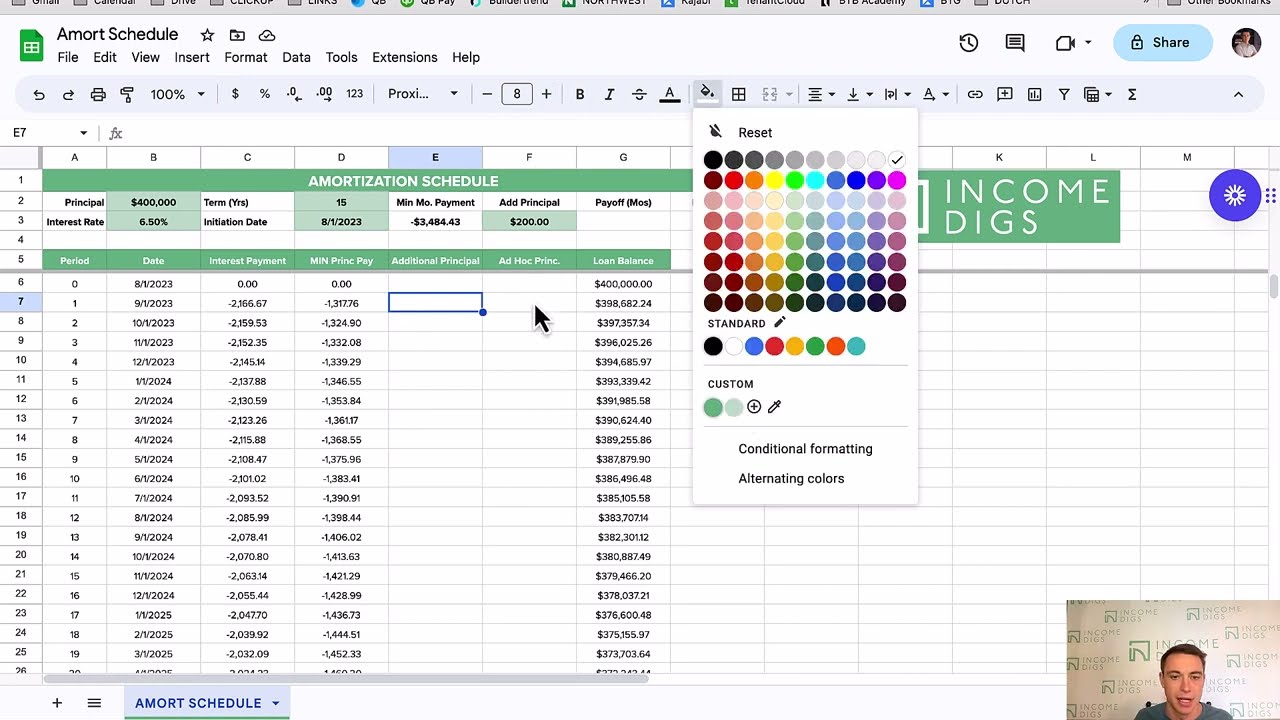

The Ultimate Amortization Calculator: Step-by-Step Guide for RE Investors

Though often used interchangeably, a loan amortization schedule and a loan term are distinct concepts. The amortization schedule refers to how payments are structured over time, determining how much of each payment goes toward interest and principal. The loan term, on the other hand, is the total time a borrower has before the loan is due in full.

For example, a loan may have a 30-year amortization schedule but only a 10-year loan term. In this case, payments are calculated as if the loan will be repaid over 30 years, but at the end of the 10-year term, the remaining balance must either be paid off in full or refinanced. This type of arrangement, known as a balloon loan, requires borrowers to plan ahead for a large final payment or secure a new loan before the term ends.

Benefits Of A Loan Amortization Schedule

Although loan amortization schedules can appear complex at first glance, they provide valuable insights that can help borrowers manage their finances effectively. Some of the key benefits include:

1. Improved Budgeting

By outlining the exact payment amount required each month, an amortization schedule helps borrowers plan their finances with certainty. This predictability ensures that they can consistently meet their loan obligations without unexpected surprises.

2. Full Cost Transparency

Seeing how payments are split between interest and principal allows borrowers to understand the true cost of their loan. By reviewing an amortization schedule, they can compare loan offers from different lenders and assess how much interest they will pay over the life of the loan.

Understanding loan amortization is key to managing your home financing effectively. By breaking down each payment into principal and interest, you can see how your debt decreases over time. To ensure the accuracy of these calculations, many experts suggest cross-checking your figures. For instance, using a tool like detector de iacan help verify that the algorithms behind your amortization schedule are based on genuine, reliable data.

3. Tax Benefits

For homeowners and business owners, some loan-related interest payments may be tax-deductible. An amortization schedule clearly separates principal and interest contributions, making it easier to track deductible expenses for tax purposes.

4. Early Repayment Planning

With an amortization schedule, borrowers can determine how making extra payments affects their loan balance and total interest costs. By making additional payments toward the principal, they can reduce the loan term and lower interest expenses.

However, it is important to check whether the lender imposes prepayment penalties, as some loans have restrictions on early repayment.

How Amortization Schedules For Intangible Assets Work

Amortization is not limited to loans businesses also use amortization schedules to account for intangible assets such as patents, trademarks, copyrights, and goodwill. In accounting, amortization helps allocate the cost of these assets over their useful life, ensuring compliance with financial reporting standards like Generally Accepted Accounting Principles (GAAP).

The process is similar to depreciation, which is used for tangible assets like equipment and buildings. The most common method businesses use is straight-line amortization, where the asset’s total cost is divided evenly over its expected useful life.

For example, if a company purchases a patent for $10,000 and expects it to remain useful for 10 years, the annual amortization expense would be:

$10,000/10 years =$1,000 per year

Unlike loan amortization, intangible asset amortization does not involve principal or interest. Instead, it is purely an accounting measure used to reflect the declining value of an asset over time. By spreading out the cost, businesses can better manage their expenses and sometimes reduce taxable income.

Example Of An Intangible Asset Amortization Schedule

An example of an intangible asset amortization schedule can be illustrated using a $10,000 patent with a useful life of 10 years. Each year, the asset is amortized by $1,000, reducing its book value until it reaches zero at the end of the term.

In the first year, the beginning balance is $10,000, and after applying an amortization expense of $1,000, the ending balance becomes $9,000. In the second year, the beginning balance is now $9,000, and after another $1,000 in amortization, the balance reduces to $8,000. This pattern continues consistently over the years.

By the third year, the asset's value decreases from $8,000 to $7,000, and in the fourth year, it drops from $7,000 to $6,000. In the fifth year, the value further declines to $5,000, followed by $4,000 in the sixth year, and then $3,000 in the seventh year.

During the eighth year, the amortization expense reduces the balance from $3,000 to $2,000. In the ninth year, the balance declines to $1,000, and in the final year, after the last $1,000 amortization expense, the asset reaches a value of zero.

This gradual reduction in book value reflects the systematic allocation of the asset’s cost over its useful life, ensuring accurate financial reporting and compliance with accounting standards.

Factors That Affect Loan Amortization

1. Loan Term Length

The length of a loan term plays a crucial role in determining the repayment schedule, monthly payments, and overall interest costs. Shorter loan terms, such as 15 years, require higher monthly payments but significantly reduce the total interest paid over time.

Borrowers who opt for a 30-year loan term, on the other hand, benefit from lower monthly payments but end up paying considerably more in interest due to the extended repayment period. The right loan term depends on the borrower’s financial situation and long-term goals.

2. Interest Rates

Interest rates directly impact the cost of borrowing and how much a borrower ultimately repays over the loan’s lifetime. Higher interest rates increase the amount of each payment that goes toward interest, slowing down the principal reduction and making the loan more expensive.

Conversely, lower interest rates reduce borrowing costs, allowing more of each payment to be applied to the principal balance. Factors such as credit score, loan type, and market conditions influence the interest rate a borrower qualifies for.

3. Extra Payments

Making additional payments toward the loan principal is one of the most effective ways to shorten the repayment period and decrease total interest costs. By allocating extra funds toward the principal balance, borrowers can accelerate loan payoff while reducing the amount of interest accrued over time.

Some lenders allow for penalty-free extra payments, making this strategy an excellent way to save money on long-term financing.

Pros And Cons Of Loan Amortization

Pros Of Loan Amortization

One of the biggest advantages of loan amortization is the predictability it offers. Borrowers benefit from a fixed repayment schedule, making it easier to budget and plan for future expenses.

Over time, as payments are made, the loan balance gradually decreases, allowing borrowers to build equity in their homes or other assets. Unlike revolving credit lines, such as credit cards, amortizing loans ensure a structured path toward full repayment, reducing financial uncertainty.

Cons Of Loan Amortization

Despite its advantages, amortization has drawbacks. In the early years of repayment, a significant portion of each payment goes toward interest rather than reducing the principal balance.

This front-loaded interest structure can make it feel like progress is slow, particularly with long-term loans like mortgages. Additionally, amortized loans provide less flexibility compared to interest-only loans or lines of credit, where borrowers have more control over payment amounts in the short term.

How To Use Loan Amortization To Your Advantage

Make Extra Payments

One of the best ways to maximize the benefits of an amortized loan is by making extra payments whenever possible. Allocating additional funds toward the principal helps reduce the outstanding balance faster, ultimately lowering total interest costs and shortening the repayment period. Even small, consistent extra payments can lead to significant savings over time.

Refinance For Lower Interest Rates

Refinancing a loan to secure a lower interest rate can substantially reduce borrowing costs. When interest rates drop, borrowers can refinance their existing loans to take advantage of the lower rates, leading to reduced monthly payments or a shorter repayment term.

However, refinancing involves closing costs and other fees, so it’s important to calculate whether the potential savings outweigh the expenses.

Opt For Biweekly Payments

Switching from a traditional monthly payment schedule to biweekly payments is another effective strategy for paying off a loan faster. By making half of the monthly payment every two weeks, borrowers end up making an extra full payment each year.

This seemingly small adjustment can significantly reduce the overall loan term and decrease the total interest paid. Many lenders offer biweekly payment options, but it’s essential to confirm whether they apply payments immediately or hold them until a full monthly amount is reached.

People Also Ask

What Is Term Amortization Loan?

The loan term describes the length of time the lender is bound by the terms and conditions of the loan agreement, while the amortization period refers to the total length of time it will take you to pay off the loan. For example, a mortgage can have a loan term of 5 years and an amortization of 20 years.

Can I Pay Off An Amortized Loan Early?

Yes. To pay off an amortized loan early, you can make payments more frequently or make principal-only payments. Since the interest is charged on the principal, making extra payments on the principal lowers the amount that can accrue interest. Check your loan agreement to see if you will be charged early payoff penalty fees before attempting this.

How Is Loan Amortization Calculated?

To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your current month. Finally, subtract that interest fee from your total monthly payment. What remains is how much will go toward principal for that month.

What Is The Difference Between Depreciation And Amortization?

Depreciation and amortization are ways to calculate asset value over a period of time. Depreciation is the amount of asset value lost over time. Amortization is a method for decreasing an asset cost over a period of time.

Final Thoughts

Loan amortization is more than a financial calculation; it's a powerful tool for understanding and controlling your financial destiny. By demystifying these complex mechanisms, you transform from a passive borrower to an informed financial strategist.

Knowledge is your most valuable asset. Embrace it, apply it, and watch as your financial decisions become increasingly sophisticated and impactful.