How To Get a Mortgage in Spain in August 2021? Tips That You Must Know

The financial or banking product on which the average saver spends the most money is mortgages or home loans. Purchasing a home with a mortgage is still a top objective for many people, and we can do it with the help of mortgage loans.

“„Our mortgage specialists explain all you need to know about comparing mortgage loans, including what a mortgage is, the many types of mortgages available, and how to get one.

If you're considering getting a mortgage in 2021, you should read this advice carefully so you can select a plan that meets your needs. We urge that you spend some time learning about mortgages and how they function so that you can make an informed decision.

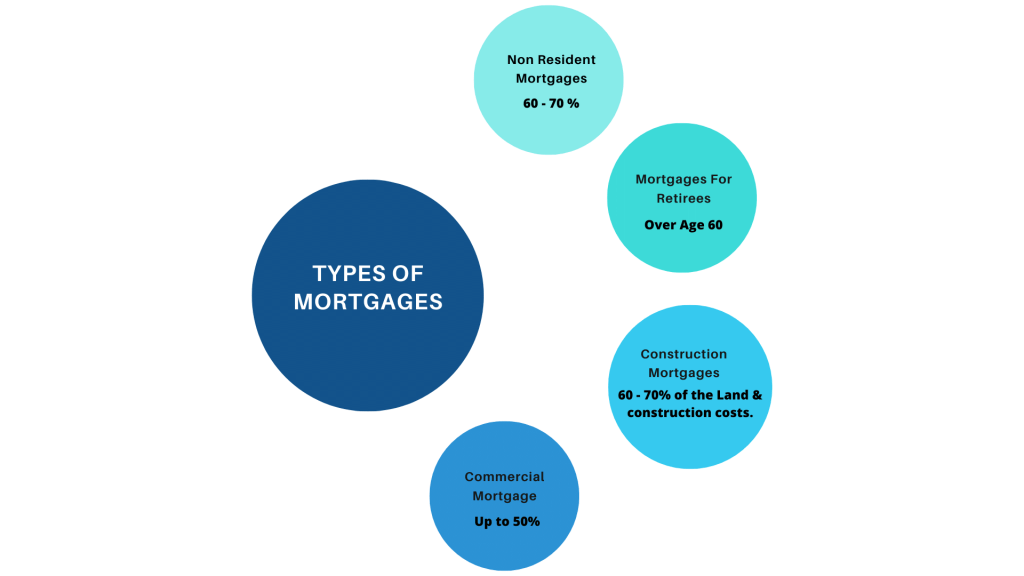

Types Of Mortgages In Spain

Spain offers the standard sorts of mortgages, as well as expat-specific Spanish mortgages from worldwide and Spanish banks. Many Spanish mortgages have no purchase price or nationality restrictions, while certain packages favor purchasers from specific nations or purchasing property in specific regions. But, what are the most common types of mortgages?

Non Resident Mortgages

The maximum loan-to-value (LTV) that banks will allow is the most significant distinction between residential and non-residential loans. Non-residents are normally limited to 60–70 percent LTV, depending on the mortgage type, but locals can borrow up to 80 percent of the property's assessed value. The good news is that when purchasing a bank-owned repossessed home in Spain, you may be able to borrow far more of the property's worth – up to 100% in some situations. Some banks may only offer mortgages to overseas buyers who are interested in their own real estate listings. In this instance, your mortgage alternatives may be very reliant on a certain home. The mortgage you acquire might be based on the bank assessor's appraisal of the property rather than the price you're paying for it in some situations. Even if your purchase price was only €100,000, you may borrow up to €87,500 if an assessor valued your house at €125,000.

Mortgages For Retirees In Spain

If you are over 60 and want to retire in Spain, you can get a mortgage as long as you are receiving a pension. You can appoint a guarantor, such as a family member, while applying for a retiree mortgage to secure the loan. If the guarantor is also a part-owner of the property, you may be able to take advantage of some tax benefits by doing so.

Commercial Mortgages

If you're starting a business in Spain, you might consider purchasing a restaurant or a shop. You can fund your investment in this situation by applying for a commercial mortgage. The requirements for business loans are a little different than they are for personal loans. In this scenario, the bank or lenders would request all relevant papers for the business you want to operate. As a result, you'll need to provide your company plans, financial statements from any previous firms, and proof of previous expertise. Commercial loans can be used to finance up to 50% of the purchase price or valuation of the company you want to buy.

Construction Mortgages

You can apply for a construction mortgage in Spain if you want to build your own home. Construction loans are tricky, and the amount of money you can acquire relies a lot on your situation. In general, you could be able to finance 60–70 percent of the total land and construction expenditures. A construction mortgage will have a higher interest rate because the danger of an unfinished project is also higher.

Getting A Mortgage As A Non Resident In Spain

It is undeniable that an increasing number of foreigners are purchasing property in Spain. According to figures published by the Spanish Property Registry, foreigners purchased more than 61,000 homes last year, accounting for 13% of all sales. In fact, foreign citizens signed 7% of all mortgages issued in Spain for the acquisition of real estate.

Non-resident mortgages are loans made by financial institutions to foreign nationals or citizens who do not have a permanent residence in the country, that is, who have not spent more than 183 days in the country during the calendar year, or who do not have Spain as the primary focus of their activities.

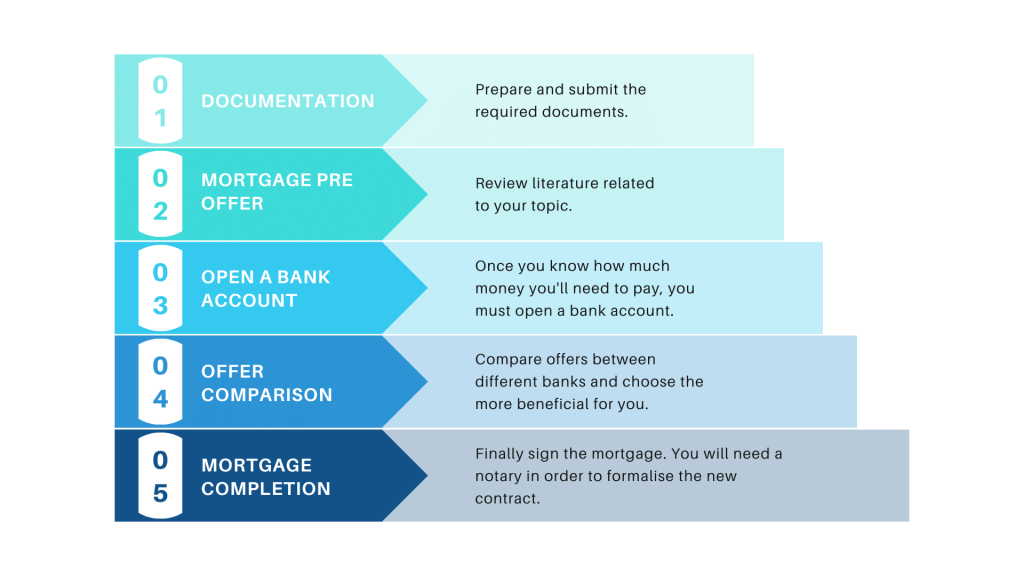

Steps To Get The Mortgage In Spain

- Prepare the appropriate documentation: You'll find a list of all the paperwork you'll need to send to your bank below. These documents will assist the bank in determining your risk profile by revealing your income and debt levels.

- Compare other banks and inquire about pre-offers: It's time to perform some mortgage research now that you have all of the relevant documentation! You can find out which banks in Spain are the best for getting a mortgage and start asking for pre-approvals. To get a pre-approval, simply send the relevant documents to the bank you believe is best suited to your needs, and they will make you an offer.

- Open a bank account: By examining all of the offers, you will be able to determine how much and when you must pay. You'll be able to open a bank account and deposit the money you'll need to pay off the mortgage this way.

- Compare Offers and Make a Decision The most suitable option is: Compare the many offers you receive and choose the bank that best meets your requirements.

- Signature on a Mortgage: Finally, the time will arrive for you to sign the mortgage document. You may need a notary at this time to formalize all of the documentation.

Take Into Consideration: While life insurance is not necessary when applying for a mortgage, certain lenders may require you to obtain property insurance, so be prepared.

Requirements For Getting A Mortgage In Spain

The standards that citizens who require a mortgage for non-residents must meet are more stringent than those that citizens who reside in Spain must meet. Why? The rationale for this is that taking assets from overseas is considerably more difficult in the event of default and non-payment, and the only guarantee would be the property obtained in Spain.

As a result, the percentage of financing allowed in non-resident mortgages is lower than in other mortgage loans, implying that a client seeking a mortgage must have a larger amount of resources to cover the initial costs. The financing percentage for this form of mortgage is roughly 60%.

In terms of repayment time, it's normally approximately 20 years at the most.

Mortgages for non-residents have a higher interest rate than mortgages for residents, mainly because it is more difficult to comply with the purchase of items linked to the mortgage, such as direct deposit of the paycheck. Furthermore, with a fixed-rate mortgage for non-residents, the customer will know exactly how much he will have to pay back and would be able to rent the home with confidence.

Required Documents To Get The Mortgage

The required documents when applying for a non-resident mortgage loan would be the following:

- Photocopy of the NIE or passport.

- Certificate indicating that you are not a resident in Spain.

- Employment contract.

- Last payslips obtained in your country of residence.

- Bank statement for the last year in which the salary is paid.

- Tax return.

- Certificate of tax residence.

- Contract of the house to be bought.

- Last three receipts of outstanding debts that have been cancelled

It will also be necessary to have the required papers translated into Spanish and to establish a Spanish bank account, as well as to present the originals in person, despite the fact that more and more financial institutions are accepting scanned documentation.

Advantages Of Starting Your Spanish Mortgage Search Early

- It costs you nothing to get started as soon as possible.

- Forward planning allows you to better understand the benefits and drawbacks of taking out a mortgage in Spain and to make the best decision possible about how much, if any, to borrow.

- Arranging your Spanish mortgage ahead of time allows you to discover the finest mortgage in Spain for your needs and avoid paying too much.

- You will have a better sense of how much you can spend on your Spanish property and can work out the likely future financial ramifications of your purchase if you take measures to arrange your Spanish mortgage early on.

- Having a Spanish mortgage in place decreases the chances of you losing a Spanish property that you have spent so much time and money finding, and it also means one less cause of concern and strain when it comes to closing on a Spanish property.

Spanish Land Classifications And Other Possible Loan Restrictions

Banks are willing to lend against urban land. Few banks will lend on property classified as Rustica or any other classification, and if they do, the loan-to-value ratio will be lower. When applying for a loan, it's a good idea to examine the land status of any potential property early on in the process. Currently, only a few Spanish banks provide building loans or financing for large-scale reforms. Loan-to-value limitations will apply where they do, and rates will most likely be higher.

Home Buyer Valuations For A Spanish Loan

Only meters that appear on the property's deeds and are completely registered at the land registry will be included in the valuation levels. Any unregistered overbuilding, expansions, or other improvements to the property will not be able to be evaluated for mortgage purposes. All lenders will utilize their chosen valuation company, albeit under new laws, you may be permitted to choose your own valuation firm as long as it is a Bank of Spain.

How Spanish Banks Assess Affordability Ratios For A Spanish Mortgage

Banks in Spain use affordability criteria based on net income rather than gross revenue.

In most cases, only earnings reported on personal tax returns are considered. Only a few Spanish banks will examine a company's net profits, and not all banks will consider all of a self-employed person's complete dividends.

Existing buy-to-let mortgages and rental incomes are treated differently by different banks. A few Spanish banks will not lend to people who have more than one investment property in the UK, and the calculation of debt outgoing vs rent coming can make it impossible for buy-to-let landlords to meet some of the banks' affordability limits.

Most banks will consider 100 percent of after-tax net income, although a few would only consider 80 percent, and some will need minimum earnings. In order to meet the standard requirements for obtaining a mortgage in Spain, your monthly outgoings for loan and debt payments, including the new loan, must be less than 35% of your net income. The fundamental underwriting criteria is affordability; the conditions do not ease at lower loan-to-value ratios, and asset wealth is not taken into account by Spanish banks.

Subrogation

It is possible to take over or subrogate an existing loan secured by the property in Spain. While many banks have discontinued giving this facility due to old loan conditions being significantly better than new loan terms, it should be investigated to see if a loan against the property you are purchasing exists. What are the conditions of the mortgage and how much capital is owed, and would the present banks consider subrogation? The main advantage of subrogation used to be that it allowed you to avoid paying mortgage deed tax, which was only applicable on new loans. Cost subrogation may be more difficult to acquire given that all banks are footing up the tab.

How Spanish Banks Assess Affordability Ratios For A Spanish Mortgage

Banks in Spain use affordability criteria based on net income rather than gross revenue.

In most cases, only earnings reported on personal tax returns are considered. Only a few Spanish banks will examine a company's net profits, and not all banks will consider all of a self-employed person's complete dividends. Existing buy-to-let mortgages and rental incomes are treated differently by different banks. Some Spanish banks will not lend to individuals who have more than one investment property in the UK, and the calculation of debt expenditure vs rent coming can make it impossible for buy-to-let landlords to meet affordability standards for some of the banks.

Most banks will consider 100 percent of after-tax net income, although a few would only consider 80 percent, and some will need minimum earnings. In order to meet the standard requirements for obtaining a mortgage in Spain, your monthly outgoings for loan and debt payments, including the new loan, must be less than 35% of your net income. The fundamental underwriting criteria is affordability; the conditions do not ease at lower loan-to-value ratios, and asset wealth is not taken into account by Spanish banks.